Our comprehensive AvaTrade review provides valuable insights you may wish to consider before trading with this leading forex broker. Enhancing your knowledge and understanding can help you make better-informed trading decisions and invest with greater confidence.

FX Trust Score Index - AvaTrade

AvaTrade gained an overall score of 85.75% across our five different ratings criteria.

FX Trust Score Index Ratings

AvaTrade Broker Pros and Cons

- Licensed & Regulated

- Comprehensive educational resources

- Hedging and scalping allowed

- Proprietary copy trading feature

- Wide range of trading platforms

- High inactivity fees

*All trading involves risk. It is possible to lose all your capital.

AvaTrade at a Glance

-

AvaTrade Overview

-

Client Support

| Overview | |

| Year Established | 2006 |

| Licences Held | ASIC (Australia), MiFID (EU), FSCA (South Africa), JFSA (Japan), ADGM (UAE), ISA (Israel), FSC (British Virgin Islands), PFSA (Polish Financial Advisory Authority), FSRA (Middle East) |

| Demo Account Available | Yes |

| Base Currencies | EUR, USD, GBP, CHF, JPY, AUD, ZAR |

| Promotions | Yes |

| Account Opening Time | Within 24 hours |

| Withdrawal Fee | None |

| Inactivity Fee | $50 after three months of inactivity |

| Minimum Deposit | $100 |

| Minimum Position Size | 0.01 lot |

| Maximum Leverage | Up to 1:400 |

| Spread Type (Fixed/Variable) | Fixed; Retail account from 0.9 pips, Standard account from 0.9 pips, Professional from 0.6 pips |

| Average Spread (based on EUR/USD) | 0.9 pips |

| Available Assets | Forex, Commodities, Indices, Stocks, ETFs, Bonds, Cryptocurrencies |

| Number of Currency Pairs | 60+ |

| Account Types | Standard |

| Mobile Trading | Yes |

| 24/7 or 24/5 Trading | 24/5 (24/7 for Cryptocurrencies) |

| Hedging Allowed | Yes |

| Scalping Allowed | Yes |

| Swap Free Account | Yes, including Islamic Accounts |

| Languages | 25 |

| Affiliate Program | Yes |

| Free Educational Resources | Yes |

| Daily Technical Analysis | Yes |

| Platforms | AvaOptions, AvaTradeGO, AvaSocial, WebTrader, MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| Payment Methods | |

| Deposit methods | Credit/Debit Cards, eWallets, Bank Transfer, Skrill, WebMoney, Neteller and more |

| Withdrawal Methods | Credit/Debit Cards, eWallets, Bank Transfer, Skrill, WebMoney, Neteller and more |

| Withdrawal times | Within 48 hours |

| Withdrawal limits | None |

| Currencies | Multiple currencies supported, including EUR, GBP, USD, CHF |

| Live Chat | Live Chat, WhatsApp, Phone, Email, 24/5 Multilingual Support, Chatbot available |

| Contact Info | Support email: Form on Contact Us page Telephone (Cyprus): +357 25 030235 Telephone (United Kingdom): +44 203 307 43 36 Website: www.avatrade.com |

| Social Media Channels | X (Twitter), Facebook, YouTube, Instagram, LinkedIn, TikTok |

*All trading involves risk. It is possible to lose all your capital.

Is AvaTrade a Trusted Forex Broker?

In this comprehensive Broker Review, we delve deeper into AvaTrade, evaluating the trustworthiness of the broker by examining a range of different factors, including fund safety, fees, educational features, promotions, online reputation and more. With a long-standing reputation in the financial markets, AvaTrade is a trusted name among traders worldwide. Keep reading to explore AvaTrade in more detail and decide if the broker is the most suitable choice to meet your trading needs.

Introduction to AvaTrade: A Brief Overview

AvaTrade is one of the best forex brokers in the highly competitive forex and CFD trading industry, recognised for its integrity and innovation. Established in 2006, it has experienced impressive growth in recent years, offering a broad spectrum of trading instruments while also maintaining a strong regulatory standing, with oversight from multiple global authorities across nine jurisdictions.

The award-winning broker is a popular choice among online traders, boasting more than one million returning clients in its global database, who benefit from a diverse range of trading platforms, including the full MetaTrader suite, proprietary platforms and social trading across desktop and mobile.

Is AvaTrade Safe?

Licensing and Regulation

AvaTrade is notable for its long list of regulatory licences, with the broker fully authorised across nine different jurisdictions, meaning it well and truly stands out among its competitors in terms of strong regulation. It holds licences from several tier-1 regulators, which include the Australian Securities and Investment Commission (ASIC), Canadian Investment Regulatory Organization (CIRO) and in the European Union via the Markets in Financial Instruments Directive (MiFIDa). AvaTrade also has the much coveted Japanese Financial Services Authority (JFSA) licence, which is notoriously difficult to obtain. Other licences include the South African Financial Sector Conduct Authority (FSCA), the Abu Dhabi Global Market (ADGM) of the UAE, the Israel Securities Authority (ISA) and the British Virgin Islands Financial Services Commission (FSC).

Security of Funds and Protection

AvaTrade implements a set of measures to ensure the security and protection of its clients’ funds, starting with the segregation of all client-related money from AvaTrade’s business funds. The broker also employs 256-bit SSL encryption across its entire website and embeds True Site Identity seal, a key security feature that verifies the authenticity of a website to its visitors. In addition, AvaTrade is WebTrust compliant, as determined by the American Institute of Certified Public Accountants, while it also uses McAfee Secure (HackerSafe) to prevent credit card fraud and identity theft. The company also offers its own unique innovation, AvaProtect, a risk management tool whereby traders pay a small fee to insure their trade and in the event that it fails, AvaTrade instantly reimburses 100% of the invested money, up to a total of $1 million.

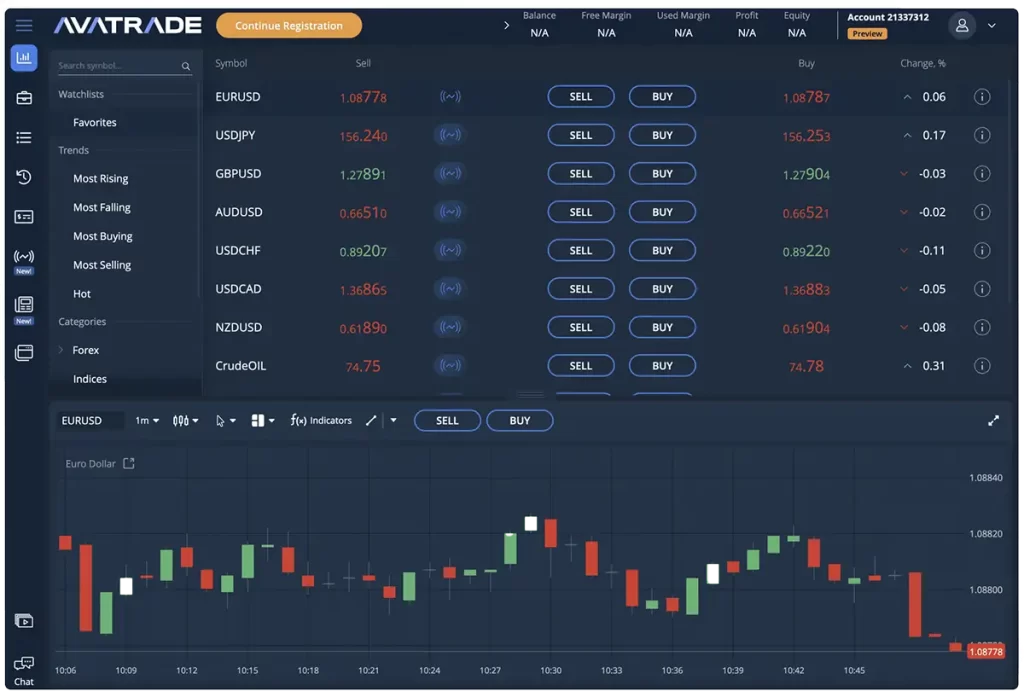

AvaTrade Trading Platforms

AvaTrade stands out among its peers in the financial industry due to its excellent selection of trading platforms. While it includes the full suite of MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms in its lineup, it also offers a WebTrader option, which has Trading Central software fully integrated into the platform, giving traders access to a range of premium technical indicators. Moreover, AvaTrade presents the AvaOptions platform which allows for sophisticated options trading and features advanced analytical and risk management tools, while the AvaSocial platform enables beginner traders to follow and copy the trades of expert traders within the AvaTrade community. Lastly, the AvaTradeGO platform is the broker’s flagship, award-winning mobile app, complete with a set of intuitive management tools, charts and other helpful features.

AvaTrade Account Types

An established, multi-licensed broker, AvaTrade offers one main trading account type to clients, known as Standard. Once they pass the various identity verification stages, traders are able to fund their account using USD, EUR and GBP. A swap-free (Islamic) is available to those traders who qualify, with more details available via the company’s customer support service. A full breakdown of the Standard account’s main features can be viewed below.

|

Account Type → Feature ↓ |

Standard |

|

Minimum Deposit |

$100 |

|

EUR/USD Spreads |

From 0.8 pips |

|

Leverage |

Up to 1:400 |

|

Margin Call |

50% |

|

Stop Out |

10% |

|

Base Currencies |

USD, EUR, GBP |

|

Minimum Position Size |

0.01 lot |

AvaTrade Trading Assets

AvaTrade accommodates a diverse range of trading approaches by offering a good variety of tradable asset classes, including more than 1,250 CFDs across seven asset classes. In total, traders can enjoy instant access to 55 currency pairs, 27 commodities, 31 index CFDs, more than 600 equity CFDs, 44 options, futures, and synthetic instruments, 58 ETFs, and 16 major cryptocurrency pairs. Overall, AvaTrade has an above average product offering in terms of available trading assets, making it one of the best CFD Brokers for traders of all experience levels.

Trading Conditions at AvaTrade

Spreads and Commissions

The exact spreads quoted by AvaTrade differ depending on the instrument traded and the account type used. Spreads on the Retail and Standard accounts both start from 0.9 pips, while there are spreads from 0.6 pips for Professional account holders. Meanwhile, the broker has a no-commission structure, meaning traders can buy or sell on the AvaTrade platforms without incurring a commission fee. With its competitive spreads and commission-free trading conditions, AvaTrade could be considered as an attractive option for traders who are conscious of costs and looking to maximise their trading profits.

Leverage

The leverage amount available with AvaTrade varies according to the client’s country of residence and the asset type traded, as the broker complies with the relevant local regulatory requirements. Due to the European Securities and Markets Authority (ESMA) regulations, retail traders in the EU have a capped leverage of 1:30 for major currency pairs and even lower for other assets like cryptocurrencies and exotic currency pairs. However, professional EU traders with AvaTrade who meet certain criteria can access the higher leverage rate of up to 1:400, which traders from other regions are able to get.

AvaTrade Customer Support

AvaTrade provides responsive customer support that is easy-to-access via live chat, phone, email and 24/7 chatbot, while traders can also communicate directly through WhatsApp. Support is available in multiple languages with customer representatives native in English, Spanish, French, German, Italian, Portuguese, Arabic and Russian. No matter where in the world clients are located, AvaTrade has their needs covered, with the broker listing dedicated local phone numbers in an impressive 36 countries across Europe, Asia, Africa, the Middle East, North America, South America and Oceania. Generally, the AvaTrade customer support service is considered to be good, but it only operates 24/5 and not at weekends, which is not ideal for traders who require round-the-clock assistance.

Educational Resources for AvaTrade Traders

There is a comprehensive range of free educational resources via the AvaTrade Education Center, which includes three categories of informative articles for beginner, intermediate and advanced level traders, along with tutorial, webinars and strategy insight pieces. Additionally, the broker’s flagship Ava Academy takes the form of a dedicated website section providing a wide selection of trading courses. Traders can access complimentary trading courses on a diverse range of subjects including forex, commodities, cryptocurrencies, stocks, indices, bonds, and ETFs. Each course offers up to 21 detailed lessons, with a varied structure made up of articles, videos, and quizzes to ensure that traders feel engaged while they learn.

AvaTrade’s Online Reputation: What Traders are Saying

AvaTrade has a mostly positive reputation among traders, who favour the broker for its user-friendly trading platforms and the wealth of educational resources available, particularly from the Ava Academy. Another popular feature is the AvaSocial platform, with traders praising how quick and easy it is to set up and the way it enables them to discover mentors, ask questions and copy trades. Moreover, a significant component contributor to AvaTrade’s positive reputation stems from its strong regulatory framework. The platform is regulated in multiple jurisdictions, providing traders with an important sense of security and trust in its overall operations.

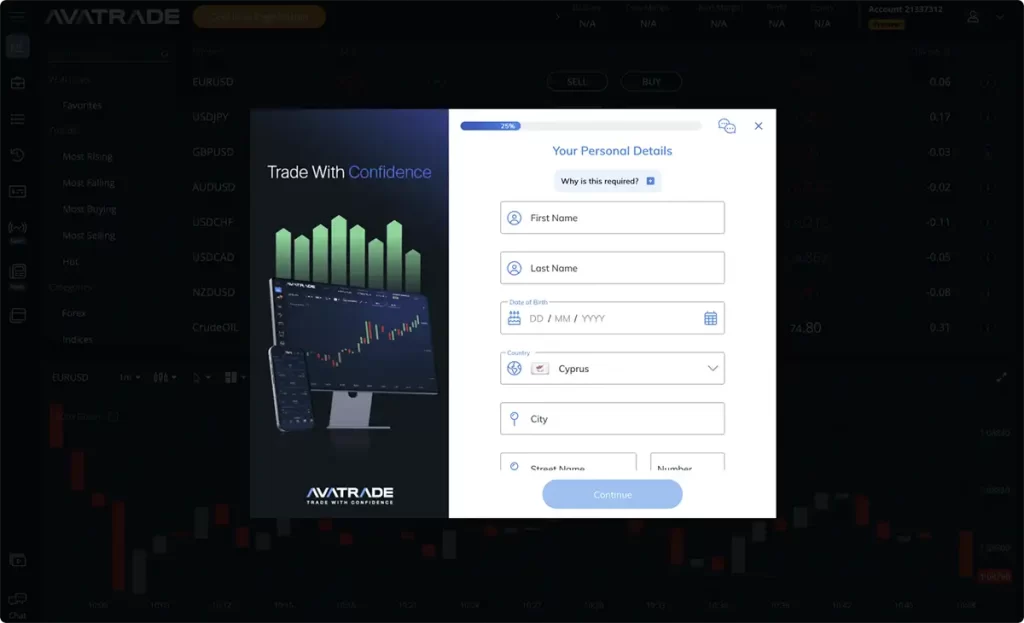

How to Open an Account

Open an account with AvaTrade by following these simple steps:

- Visit the homepage and click the Register Now Button.

- Fill out your chosen username (email) and password and click Create My Account.

- A window will appear prompting you to continue adding your personal details.

- You will then be taken to the Trading Platform.

- If you interrupt your registration process, you can save and continue later by clicking the orange Continue Registration button within the Trading Platform.

- Please note that you will have to provide KYC documents in order to utilise your account to the fullest extent.

Featured Promotions

AvaTrade states that from time to time it issues welcome bonus promotions dedicated for new clients, but there is an excellent ‘Refer a Friend’ promotion on offer to all clients.

- Refer a Friend: Clients can earn up to $250 as a referral bonus for every friend that deposits and trades. To qualify for this promotion, they need to share a unique referral link with their friends through Facebook, WhatsApp or Gmail. Once their friends open a real trading account, make a minimum first-time deposit (FTD) of $500 and open at least 10 trades, the client will receive cash credit ranging from $50 to $250, depending on their friend’s FTD amount.

- Regular Bonuses: AvaTrade occasionally updates its promotional campaigns, which vary according to geographical region. In the past, the broker has offered several attractive promotions to its clients, ranging from generous welcome and deposit bonuses. To find out the latest offers available at AvaTrade, clients are encouraged to visit the broker’s official website to see how they can receive a trading boost.

The FXTS Verdict: Is AvaTrade a Trusted Broker?

AvaTrade is a solid all-round choice for traders who prefer to trade with an established and trusted broker that not only takes its regulatory requirements seriously but also offers a broad range of trading platforms. There are a number of unique features available to AvaTrade clients, such as the comprehensive Ava Academy which offers a much greater depth of trading courses than many of the broker’s closest rivals. The AvaSocial copy trading platform is also well-regarded by beginner and advanced traders alike. While there is less focus on its promotional offering, AvaTrade makes up for this shortcoming through its competitive trading conditions and excellent range of trading assets. In conclusion, AvaTrade is the broker of choice for traders of all experience levels who want to trade with a reliable and reputable broker, safe in the knowledge that their funds are secure.

*All trading involves risk. It is possible to lose all your capital.

FAQs

AvaTrade is recognised within the online trading community as being a trusted broker, thanks largely to its steadfast commitment to regulatory oversight in no less than nine jurisdictions. Since being founded in 2006, the company has built up a solid reputation over the years for providing reliable trading services and prompt customer support.

AvaTrade prioritises the safety of client funds and is considered a secure place for your money, underscored by various robust safety measures. The broker is fully authorised by multiple tier-1 regulators across the world, meaning it maintains strict adherence to stringent operational standards. Furthermore, AvaTrade ensures the segregation of client finds, employs advanced security technologies and offers risk management tools like negative balance protection, helping clients control losses and trade within safe limits.

AvaTrade has a minimum deposit of just $100 across its Retail, Standard and Professional account types.

AvaTrade has a seamless withdrawal process, enabling clients to receive their money promptly and stress-free. The broker states that it will only take between 24-48 hours to complete the withdrawal process once a client’s account has been verified, compared to other brokers who have a timeline of up to 8 days to process a withdrawal request.

AvaTrade is an established global broker, pioneering online trading in a competitive marketplace since the company was first founded back in 2006. It is one of the world’s most secure brokers, with seven regulations across six continents, while at the same time offering a wide choice of assets, leading platforms and attractive trading conditions.