Our comprehensive Pepperstone review provides valuable insights you may wish to consider before trading with this leading forex broker. Enhancing your knowledge and understanding can help you make better-informed trading decisions and invest with greater confidence.

FX Trust Score Index - Pepperstone

Pepperstone gained an overall score of 83.5% across our five different ratings criteria.

FX Trust Score Index Ratings

Pepperstone Pros and Cons

- 24/7 phone support

- Good educational resources

- cTrader and TradingView platforms

- Industry-leading low spreads

- Fast and reliable execution

- Not available to US residents

*All trading involves risk. It is possible to lose all your capital.

Pepperstone at a Glance

-

Pepperstone Overview

-

Client Support

| Year Established | 2010 |

| Licences Held | ASIC (Australia), FCA (United Kingdom), DFSA (UAE), CMA (Kenya), SCB (Bahamas), BaFin (Germany) |

| Demo Account Available | Yes |

| Base Currencies | EUR, USD, GBP, AUD, JPY, CAD, CHF, NZD, SGD, HKD |

| Promotions | Yes |

| Account Opening Time | Within 24 hours |

| Withdrawal Fee | None |

| Inactivity Fee | None |

| Minimum Deposit | $0 |

| Minimum Position Size | 0.01 lot |

| Maximum Leverage | Up to 1:500 |

| Spread Type (Fixed/Variable) | Variable; Standard account from 1.0 pips, Razor from 0.0 pips |

| Average Spread (based on EUR/USD) | 1.1 pips |

| Available Assets | Forex, Commodities, Indices, Currency Indices, Shares, ETFs, Cryptocurrencies |

| Number of Currency Pairs | 90+ |

| Account Types | Standard, Razor & Pro |

| Mobile Trading | Yes |

| 24/7 or 24/5 Trading | 24/5 (24/7 for Cryptocurrencies) |

| Hedging Allowed | Yes |

| Scalping Allowed | Yes |

| Swap Free Account | Yes, including Islamic Accounts |

| Languages | 25 |

| Affiliate Program | Yes |

| Free Educational Resources | Yes |

| Daily Technical Analysis | Yes |

| Platforms | TradingView, cTrader, WebTrader, Mobile App, MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| Payment Methods | |

| Deposit methods | Credit/Debit Cards, eWallets, Bank Transfer, PayPal, Neteller, Skrill, Union Pay and more |

| Withdrawal Methods | Credit/Debit Cards, eWallets, Bank Transfer, PayPal, Neteller, Skrill, Union Pay and more |

| Withdrawal times | Same business day if before 21:00 GMT |

| Withdrawal limits | You can only withdraw up to 90% of your free margin for International Bank Wire Transfers |

| Currencies | Multiple currencies supported, including EUR, GBP, USD, CHF |

| Live Chat | Phone, Email, 24/7 Multilingual Support, Live Chat, WhatsApp, Chatbot available |

| Contact Info | Support email: support@pepperstone.com Telephone (Cyprus): +357 25 030 573 Telephone (United Kingdom): +44 (800) 0465 473 Website: https://pepperstone.com/ |

| Social Media Channels | X (Twitter), Facebook, YouTube, LinkedIn, Telegram, TikTok |

*All trading involves risk. It is possible to lose all your capital.

Is Pepperstone a Trusted Forex Broker?

In this comprehensive review, we will delve deeper into Pepperstone, evaluating the trustworthiness of the broker by examining a range of different factors, including fund safety, fees, educational features, promotions, online reputation and more. As a prominent player in the online trading industry, Pepperstone has an entrenched position in what is a highly competitive market. Explore our detailed review below to learn more about this brokerage and see if it aligns with your trading needs before you make your next trading decision.

Introduction to Pepperstone: A Brief Overview

Pepperstone, founded in 2010, is a renowned name in the forex and CFD trading industry, having developed a strong reputation among traders for offering an extensive range of trading options and educational resources. The broker presents an excellent choice of trading platforms and allows traders to access more than 1,200 tradable CFD instruments across an impressive eight asset classes.

First established with the goal of creating a better trading experience for its clients, Pepperstone leverages cutting-edge technology to provide fast execution speeds and low-cost trading. Over the years, it has expanded its services internationally, with offices in major financial cities around the world, ensuring a broad and inclusive trading environment for traders of all experience levels.

Is Pepperstone Safe?

Licensing and Regulation

Pepperstone is a reputable broker that is licensed by several top-tier regulatory bodies, being fully authorised by the Australian Securities and Investment Commission (ASIC), the UK’s Financial Conduct Authority (FCA) and the Dubai Financial Services Authority (DFSA) in the United Arab Emirates. Pepperstone’s adherence to the rules set by multiple regulatory bodies demonstrates its commitment to best practices across all operational aspects, from customer service to financial reporting and risk management. This serves to build trust among traders, who can trade confidently with a broker that values professionalism and high standards.

Security of Funds and Protection

Pepperstone ensures that when a client opens a trading account their funds are in safe hands at all times. The broker achieves this by implementing a raft of security measures designed to keep their money protected. For example, clients’ funds are held in segregated client bank accounts at regulated banks, with all retail client money being distributed across major banks, which are regularly assessed against Pepperstone’s risk criteria. Moreover, Pepperstone does not use retail client money for hedging trades with other counterparties, while clients’ assets are protected from creditors in the event that Pepperstone goes into liquidation. Lastly, the broker is signed up as a member of the UK’s Financial Services Compensation Scheme (FSCS), which provides a safety net for clients of authorised firms.

Pepperstone Trading Platforms

Pepperstone offers a range of sophisticated trading platforms to cater to various trading preferences and strategies. The broker presents the globally popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are renowned for their reliability and wide range of superior tools and functions. In addition, clients can also access cTrader, an easy-to-use and intuitive trading platform that offers powerful charting, advanced order entry and extensive customisations. Moreover, Pepperstone includes the user-friendly TradingView as part of its platform lineup, which has an impressive range of features such as advanced charting technology, impressive social trading network and a vast range of pre-built and customisable indicators.

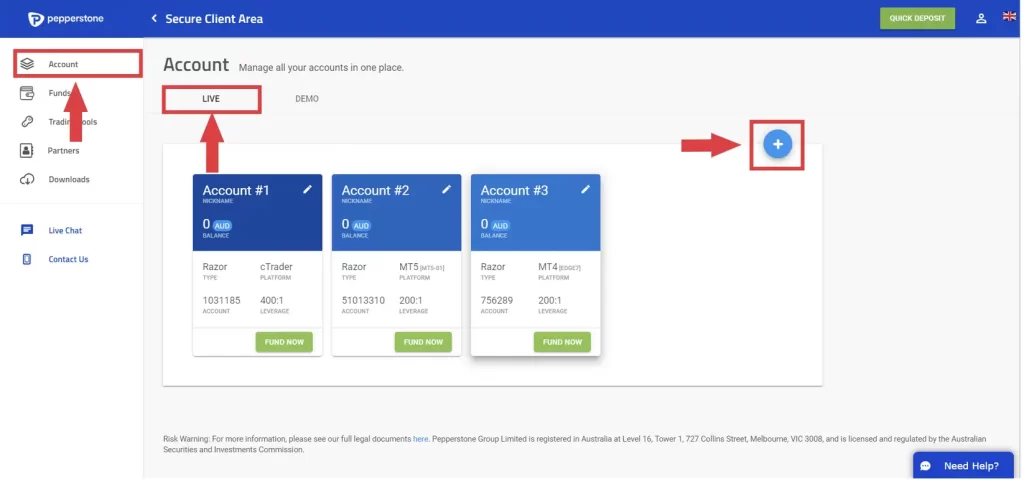

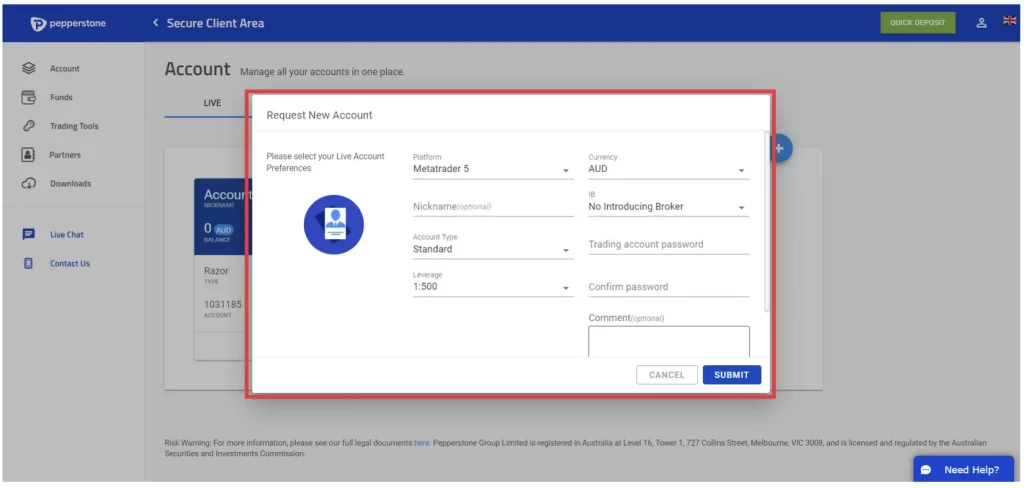

Pepperstone Account Types

There are a total of three account types available with Pepperstone broker: Standard, Razor, Pro. No minimum deposit is required from traders, meaning they can fund their account in any amount they wish, with a choice of USD, EUR and GBP. The Standard account features competitive trading conditions, but the Razor and Pro options offer superior pricing, including tighter spreads and higher leverage. For a more detailed comparison, view the table below.

|

Account Type → Feature ↓ |

Standard |

Razor |

Pro |

|

Minimum Deposit |

$0 |

$0 |

$0 |

|

EUR/USD Spreads |

From 1.0 pips |

From 0.0 pips |

From 0.0 pips |

|

Leverage |

Up to 1:30 |

Up to 1:30 |

Up to 1:500 |

|

Margin Call |

90% |

90% |

80% |

|

Stop Out |

50% |

50% |

50% |

|

Base Currencies |

USD, EUR, GBP |

USD, EUR, GBP |

USD, EUR, GBP |

|

Minimum Position Size |

0.01 lot |

0.01 lot |

0.01 lot |

Pepperstone Trading Assets

Pepperstone provides a wide assortment of CFD instruments from various asset classes, giving traders opportunities to speculate on the dynamic movements of the global financial markets. The broker presents more than 1,200 tradable instruments, including more than 90 major and minor currency pairs, more than 1,000 individual share CFDs and over 20 CFDs on the most popular cryptocurrencies. Further to this, Pepperstone offers many more instruments for clients to trade on their platform via a range of asset classes, most notably commodities, indices, currency indices and ETFs.

Trading Conditions at Pepperstone

Spreads and Commissions

Pepperstone is regarded as one of the best brokers on the market for providing competitively low spreads, which vary depending on the type of instrument traded. On Standard accounts, spreads start from 1.0 pips on EURUSD, GBPUSD, USDJPY, AUDUSD, while Razor accounts offer zero spreads on the same currency pairs. For EURGBP the spreads start from 1.2 pips on Standard accounts and from 0.2 pips on Razor accounts. Meanwhile, commissions are only charged on Razor accounts when clients trade CFDs on forex, with a charge of $3.50 per one standard FX lot per side, while commissions on trades lower than one lot are proportionally adjusted and rounded up.

Leverage

The leverage available to Pepperstone traders differs between geographical regions and the instruments traded. Under the CySEC jurisdiction, retail clients can trade with a leverage of up to 1:30, while professional clients can get access to leverage of up to 1:500 on FX and a range of other instruments. Additionally, retail clients can get leverage rates of 1:30 for major currency pairs, 1:20 for non-major currency pairs, gold and major indices, 10:1 for commodities other than gold and non-major equity indices, 1:5 for individual equities and 2:1 for cryptocurrencies. These leverage opportunities offer traders the ability to customise their trading strategies and risk tolerance within the regulatory guidelines of the country they are trading from.

Pepperstone Customer Support

Pepperstone is one of the better brokers when it comes to offering comprehensive customer support options to its clients. It stands out among its closest competitors with round-the-clock multilingual phone support available 24/7, as opposed to the 24/5 weekday assistance provided by many other brokers. Moreover, Pepperstone’s highly responsive support agents are on hand to help via email and through live chat, using their expertise to handle a range of inquiries from basic queries to more complex issues. The broker’s customer support team offers a supportive service for traders seeking to get speedy and reliable answers to any trading-related questions.

Educational Resources for Pepperstone Traders

Traders can access a wide range of informative articles, trading guides and interactive webinars as part of an excellent selection of educational resources provided by Pepperstone. The broker’s website features a rich library of platform tutorial videos, including a dedicated course specifically focused on the MT4 platform. For those who prefer visual learning, Pepperstone’s YouTube channel has hundreds of videos covering a wealth of topics, including forex basics, technical analysis, platform walkthroughs and insightful podcast episodes. There is also a trader’s glossary containing all the key terms and phrases beginner traders need to know about before starting their trading journeys. Overall, Pepperstone’s educational resources stand out as one of the more comprehensive offerings currently available on the market right now.

Pepperstone’s Reputation: What Traders are Saying

Pepperstone maintains a strong online reputation, with largely positive reviews received from thousands of traders worldwide. The most popular features among clients include the vast educational resources on offer, the excellent platforms available and the competitive trading conditions – most notably the low spreads available and fast execution speeds. Another aspect that traders tend to speak highly of is the 24/7 customer support service, which is particularly helpful to clients who prefer round-the-clock assistance on weekends. Generally speaking, clients will feel confident that by opening an account with Pepperstone they are trading with a secure and reliable broker due to the broker’s strong regulatory framework.

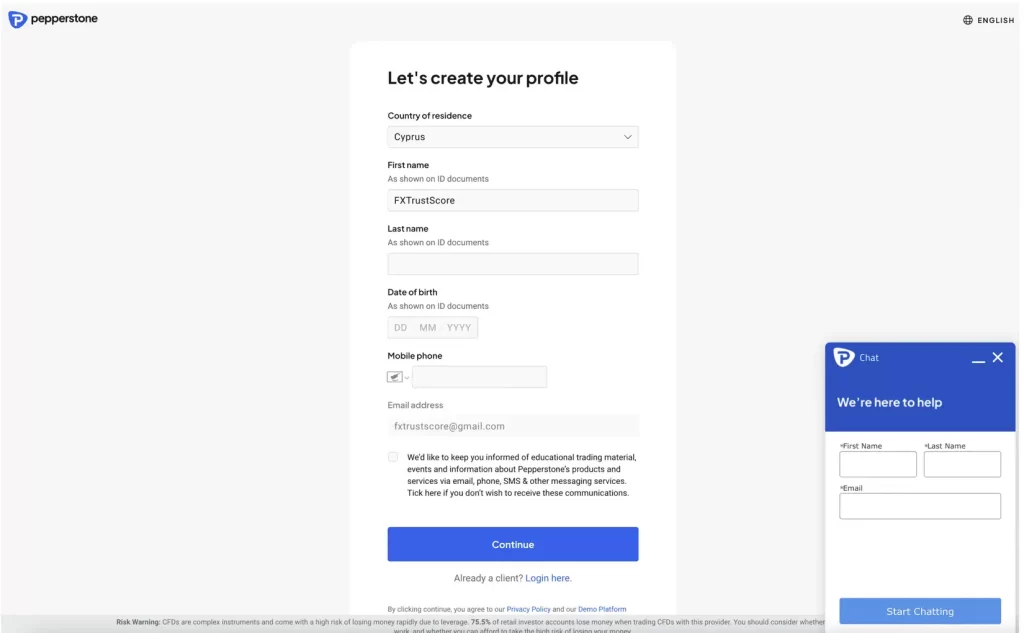

How to Open an Account

Open an account with Pepperstone by following these simple steps:

- Visit the homepage and click the Join Now Button.

- Select to sign up using Apple, Google, Facebook or Email.

- Create your Profile by filling in your personal details and click Continue.

- If you need assistance, you may use the Live Chat facility.

- Your account will be created and you can access the secure client area where you can create your Demo and Live Trading Accounts.

- Your account will have to be KYC-Verified before you can fully utilise your trading account.

Featured Promotions

Pepperstone offers two ‘Refer a Friend’ programs, with one for retail clients and another for professional clients (known as Pepperstone Pro clients). It also has an ‘Active Trader’ program available exclusively to high volume traders.

- Refer a Friend Program: Retail clients and their friends can earn up to 20 commission-free trades 20 trades on eligible FX and share CFDs when their referral deposits $2,000 within 90 days of opening an account. Professional traders and their friends can each receive a bonus of between $50 and $1,000 depending on how many lots are traded by their referral within 90 days of opening an account.

- Active Trader Program: Aimed at high-volume traders, this promotion allows participants to earn rebates based on their monthly trading volume. Clients can get rebates on forex (15% to 25%), indices (10% to 20%) and commodities (5% to 15%), according to the specific volume traded. The rebates are paid daily or monthly, depending on the account type used.

The FXTS Verdict: Is Pepperstone a Trusted Broker?

Pepperstone is a trusted and reliable multi-regulated broker that adheres to a strict set of operational standards, as evidenced by a range of client protection measures, including the segregation of client funds and negative balance protection. Moreover, the 24/7 customer support gives the broker much credibility in that clients are able to receive prompt assistance at any time of day – including on weekends. Pepperstone is a truly international broker, serving clients from more than 160 countries worldwide with 1,200+ trading instruments, low spreads, fast execution and deep liquidity. With all the above factors considered, it is easy to conclude that Pepperstone is a trustworthy broker that operates on a large scale, yet offers personalised round-the-clock support to its clients.

*All trading involves risk. It is possible to lose all your capital.

FAQs

Yes, Pepperstone is considered a trusted broker. It is regulated by several top-tier financial authorities including the Australian Securities and Investments Commission (ASIC), the UK’s Financial Conduct Authority (FCA), and the Cyprus Securities and Exchange Commission (CySEC). These regulatory bodies ensure that Pepperstone adheres to strict financial standards and operational guidelines, providing a secure and transparent trading environment for its clients.

Pepperstone ensures client funds are always kept secure thanks to implementing a range of protective measures. The broker holds client money in segregated accounts at top regulated banks and does not use client funds for its own hedging purposes, while it is also a member of the UK’s Financial Services Compensation Scheme (FSCS).

Pepperstone was originally founded in Melbourne, Australia in 2010. In the years since its establishment, the broker has expanded significantly, serving clients in multiple countries across the globe, while maintaining its headquarters in Australia.

Yes, Pepperstone is regulated in Europe. It is fully licensed and authorised by the Cyprus Securities and Exchange Commission (CySEC) and the UK’s Financial Conduct Authority (FCA), ensuring compliance with strict financial standards and providing secure trading conditions in the European market.

Pepperstone does not require a minimum deposit to open a trading account, making it very accessible for traders who may want to start with a smaller amount of capital. This flexibility allows both novice and experienced traders to begin trading with an amount they feel comfortable with.