An Introduction to Proprietary Trading

Proprietary trading, also known as prop trading, has become one of the most dynamic areas of modern trading. Prop trading firms provide skilled traders with access to capital, allowing them to trade financial markets using company funds rather than their own. In exchange, the firm retains a percentage of the profits.

The concept has gained significant traction among retail traders who want the opportunity to scale their trading without risking large personal sums. By proving their consistency and discipline, traders can earn access to funded accounts and increase their exposure over time.

In this guide, we explain how prop trading works, what to expect from a proprietary trading firm and how to identify the best opportunities in 2025 and beyond. We also provide in-depth reviews of top firms such as our Ultimate Traders Review.

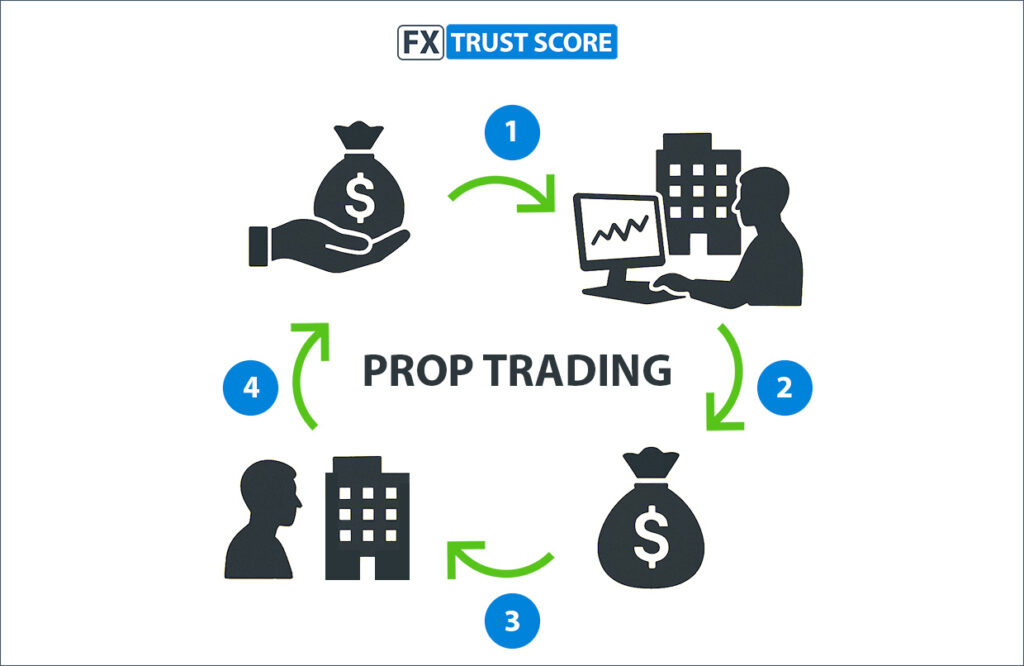

Overview of how prop trading works

What Is a Proprietary Trading Firm?

A proprietary trading firm is a company that allocates its own funds to traders in exchange for a share of any profits they generate. Unlike a traditional broker, which earns from spreads or commissions, a prop firm’s income depends on the trader’s performance.

To remain sustainable, prop firms apply strict risk management rules, such as maximum drawdowns, profit objectives and daily loss limits, to protect their capital. These rules ensure that traders perform responsibly and that only the most consistent individuals retain funded status.

Many firms now include structured scaling plans. Traders who maintain strong results over time may gain access to higher funding tiers. This benefits both sides: traders can grow their potential returns, and firms can focus capital on proven performers.

Ultimately, proprietary trading firms form a partnership built on trust and accountability. The firm supplies the infrastructure and funding, and the trader delivers skill, strategy, and discipline.

How Do Prop Trading Firms Work?

Although all prop firms share the same core principle, their operational models can vary widely. Before joining, it is worth understanding the typical components of a prop firm’s setup.

Funding & Capital Allocation

Traders usually start with a demo or simulated account to meet profit and risk targets. Once the challenge is completed, they progress to a funded stage. Capital allocations differ by firm but often range from $10,000 to $400,000 or more, depending on scaling structures and performance.

Profit Split & Fees

Once funded, traders earn a percentage of their profits, typically between 70% and 90%. Most firms charge a one-time evaluation fee to access the challenge stage. It’s also worth checking whether a company applies ongoing costs such as platform or withdrawal fees before you commit.

Trading Platforms & Tools

Reputable firms provide access to established trading platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), or cTrader. Many now offer in-platform dashboards showing live statistics, drawdown tracking, and trade analytics. Educational resources, support channels, and mentorship programmes are also becoming more common.

Evaluation Process & Rules

The evaluation phase is designed to assess a trader’s consistency. Each challenge includes clear parameters: profit targets, daily loss limits, and minimum trading days. Most firms operate one or two challenge stages before providing funded access. The process ensures that capital is allocated only to disciplined and consistent traders.

Key Criteria for Evaluating Prop Trading Firms

If you have made it this far, well done! It means you will have read through our introductory sections which explains all about what prop trading is and how prop firms operate. Whether you are completely new to the industry or an experienced trader, the important next step is to properly evaluate the different prop firm options available to you.

To help minimise your research time and maximise your decision-making efficiency, we decided to create a list of the most important points to consider, so you can make a more effective prop firm comparison. Keep reading on to see what we have included in our best prop trading firms criteria.

Capital and Leverage

Examine how much funding the firm provides and whether scaling opportunities are available. Initial allocations can range widely, so check leverage ratios, which may differ between forex, indices, and commodities.

Profit Split Ratio

Look for firms that reward traders fairly – many offer splits between 70/30 and 90/10. Also note whether the structure is fixed, tiered or performance-based, as this affects your long-term earning potential. For example, Ultimate Traders uses a two-step challenge and profit split structure which illustrates how these criteria play out in real-world firms.

Fees, Commissions and Minimums

Analyse all costs upfront, including one-time entry fees, spread charges, or platform subscriptions. Some firms charge only an initial fee, while others add small maintenance charges. Calculating the total cost helps you compare the real value of each offer.

Evaluation Requirements

Rules vary between companies, so read each one carefully. Make sure you understand the required profit target, maximum drawdown, and minimum trading days before starting.

Payout Frequency and Methods

Reliable, regular payouts are crucial. Some firms offer bi-weekly or even daily withdrawals. Confirm payment methods and thresholds so you know when and how you will receive your profits.

Platform Features and APIs

Choose firms that use trusted platforms like MT4, MT5, cTrader, or TradeLocker. Many also include tools such as automated trade tracking, risk dashboards, and API integration for advanced strategies.

Types of Prop Trading Firms

As prop trading has evolved, two main structures have emerged: evaluation-based firms and instant funding firms. Each has its own benefits and considerations.

Evaluation-Based Firms

The most common model, evaluation-based firms require traders to complete a challenge before accessing funded capital. The process rewards consistency, as only those who meet defined profit and drawdown limits move forward. Successful traders gain access to real profit-sharing accounts with ongoing scaling potential.

Instant Funding Firms

Instant funding firms skip the evaluation phase entirely. Traders pay a higher one-off fee to begin trading immediately. These accounts often have smaller allocations and tighter risk rules, but they provide immediate access for those who prefer faster entry.

Evaluation-based vs. Instant Finding Differences

| Feature | Evaluation-Based | Instant Funding |

|---|---|---|

| Initial Challenge | Yes | No |

| Access to Capital | After passing evaluation (1-2 stages) | Immediate (after payment) |

| Speed of Funding | Slower – depends on evaluation length | Fast – usually within 24-48 hours |

| Upfront Cost | Lower | Higher |

| Scaling Plans | Common for consistent traders | Less frequent |

| Risk Level | Lower – only evaluation fee at risk | Higher upfront fee at risk |

Pros and Cons of Trading with a Prop Firm

Both models have benefits and drawbacks depending on your experience and goals. The table below summarises the main advantages and challenges of prop trading.

One case in point is Ultimate Traders, whose model offers an 80/90% profit split but enforces drawdown limits and a multi-phase evaluation. See our full Ultimate Traders review.

| Pros | Cons |

|---|---|

| Access to larger trading capital | Firms take a share of profits (often 10-30%) |

| Limited personal financial risk | Must follow strict trading rules and targets |

| Professional platforms and tools | Possible hidden or recurring fees |

| Structured learning and community support | Evaluation stages can be demanding |

How to Choose the Right Prop Trading Firm for You

With hundreds of firms now operating worldwide, choosing the right one requires careful consideration. Here’s a simple checklist to guide your decision.

Clarify your trading style and timeframe – Decide whether you prefer scalping, day trading, or swing trading, then look for firms that support your strategy.

Compare funding and profit splits – Review account sizes, scaling options and payout structures.

Trial an evaluation challenge – Many firms offer free demo challenges that let you experience the platform before committing.

Read verified trader reviews – Platforms like Trustpilot and trading forums give insight into company reliability and support quality.

Calculate cost versus potential return – Always weigh the possible profit share against total fees and trading costs to gauge value for money.

Explore Our Best Prop Trading Firms 2025

If you are ready to compare live options, explore our Best Prop Trading Firms 2025 rankings based on detailed research and the FX Trust Score Index. Each company has been assessed for funding options and scaling plans, profit splits, evaluation rules, trading conditions, costs and online reputation.

Whether you want a high profit share, flexible scaling or minimal fees, our exclusive leaderboard highlights the top-performing prop firms currently available.

For deeper insights into how each firm operates, check out our Ultimate Traders Review and other detailed reviews.

Conclusion and Next Steps

Proprietary trading offers a valuable way for skilled traders to access substantial funding without risking personal capital. By passing structured evaluations and trading responsibly, it’s possible to grow steadily within a supported framework.

Choosing the right prop trading firm depends on your style, discipline, and financial goals. With sound research and consistent execution, prop trading can become a rewarding partnership between trader and firm – one built on professionalism, accountability, and shared success.

Further Reading

Ultimate Traders Review – a full review covering rules, fees, pros & cons and more.

Best Prop Trading Firms 2025 – our ranking of the top prop firms.

FAQs

A proprietary (prop) trading firm lets you trade the firm’s capital and share profits if you follow its rules. Models vary, but most are either evaluation-based (you pass a challenge or verification) or instant-funding (no challenge, higher fees and stricter risk).

Prop trading as an activity is legal in many jurisdictions, but retail prop firms are typically not licensed like forex brokers; they operate under company law and their own contracts. Always review a firm’s registration details, T&Cs and local requirements before registering.

Instant funding gives you immediate access to a funded account (usually at a higher upfront cost and tighter rules). Evaluation-based firms require you to pass 1–2 steps with profit targets and drawdown limits before funding. Pick based on budget, rule tolerance and time.

Most firms use profit targets, daily loss caps and overall/trailing drawdown. Trailing drawdown moves up as you make profits; static/overall drawdown doesn’t trail. Always read each firm’s rulebook as limits and definitions vary.

Policies differ: some firms restrict news trading on funded accounts or certain account types but allow it during evaluation; others offer “swing” accounts with more flexibility. Check the firm’s news/overnight policy before you trade.

Payout schedules range from weekly to monthly depending on the firm. You’ll typically need to complete KYC/identity verification before your first withdrawal. Review the payout cadence, methods and thresholds in each firm’s policy.

Many traders cap risk at 1–2% per trade to stay within daily or overall loss limits and avoid breaching rules. Choose a fixed percent risk model that fits the firm’s drawdown math and your edge.

There is no single “best” for everyone. Look for clear rules, fair drawdowns, transparent payouts, and responsive support. Start with our short-listed picks: see Best Prop Trading Firms 2025.

Publication date:

12/08/2025

Author: FX Trust Score

Last updated on October 15, 2025