Understanding Leverage in Forex

Leverage is one of the defining features of forex trading. It allows traders to open positions much larger than their initial deposit by borrowing funds from their broker. In simple terms, leverage magnifies both profits and losses.

Used well, it’s a useful tool for increasing market exposure and making efficient use of capital. Used poorly, it can lead to rapid and significant losses. That’s why understanding how leverage functions is an essential step for any trader.

What Does Leverage Mean in Practice?

Leverage works by allowing you to commit only a portion of the total trade value – known as the margin – while the broker effectively covers the rest. This arrangement multiplies the impact of every market movement.

For example, if your broker offers 1:100 leverage, you can control £100,000 in the market with just £1,000 of your own capital. A small 1% change in price could therefore result in a £1,000 profit – or a £1,000 loss.

That power cuts both ways. Leverage can increase opportunity, but it also magnifies mistakes.

How Leverage Works in Forex Trading

Every trade in forex is made up of a currency pair, such as EUR/USD or GBP/JPY. When you use leverage, you’re still buying and selling these pairs in the same way, but your broker temporarily extends your buying power.

The portion of your own funds you put down acts as collateral, known as margin. If the market moves against your position and your losses approach that margin amount, your broker may issue a margin call, asking you to deposit more funds to maintain the position.

Because of this, leveraged trading requires careful planning, constant monitoring and strong emotional control.

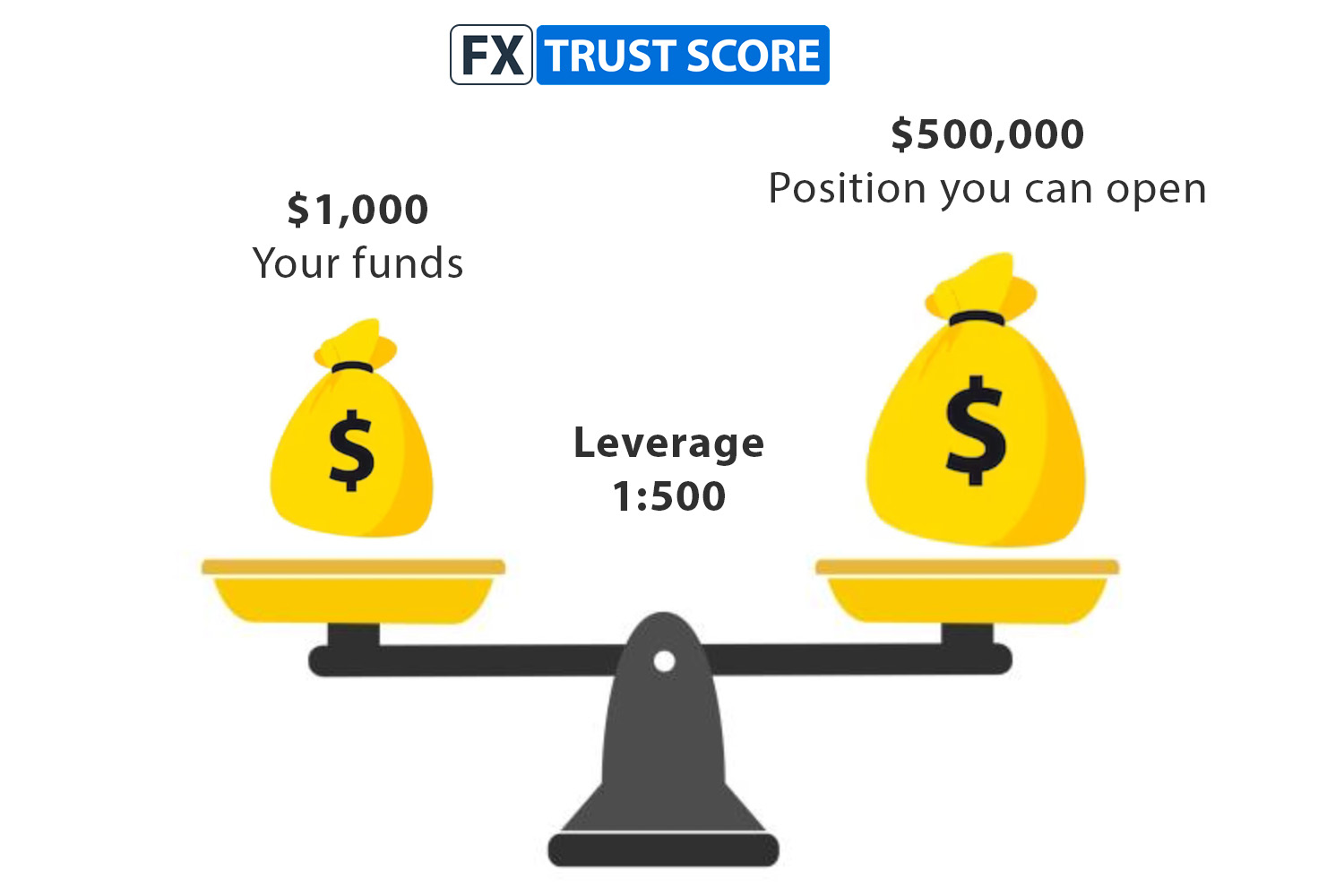

Leverage Ratios and What They Mean

Leverage is normally expressed as a ratio:

-

1:10 – you can trade ten times your deposited amount

-

1:50 – fifty times your capital

-

1:500 – five hundred times your capital

The higher the ratio, the greater your exposure. Many retail traders start small, then increase leverage as they gain experience and develop consistent risk management habits.

Choosing the Right Leverage

There is no universal “best” level of leverage. The right ratio depends on your strategy, capital size, and appetite for risk.

For newcomers, lower leverage such as 1:10 or 1:30, provides a sensible balance. It keeps potential losses within reach and gives you room to learn.

More seasoned traders may opt for 1:100 or higher, particularly if they use short-term strategies or hedge multiple positions at once. However, even experienced traders rarely use maximum leverage on every trade. Prudence is part of the skill.

Why Leverage Can Be Risky

The biggest danger of leverage is how quickly losses can compound. A price move of just one percent against your position could wipe out your margin entirely if you’re over-leveraged.

Leverage can also create a false sense of confidence, tempting traders to take on positions that are too large or to ignore stop losses. The best defence is preparation. That means knowing how much of your capital you’re willing to risk on a single trade – and sticking to it.

Using Leverage Responsibly

Successful traders treat leverage as a practical tool rather than a shortcut to fast profits. Here are a few proven ways to keep it under control:

1. Plan each trade before opening it.

Decide your entry and exit points in advance, including your risk/reward ratio. Avoid impulsive trades based on emotion.

2. Always use stop-loss orders.

A stop loss acts as a safety net, automatically closing a position once it reaches your maximum acceptable loss.

3. Keep position sizes realistic.

Avoid committing too much margin to a single trade. Diversifying smaller positions is usually safer than betting heavily on one outcome.

4. Monitor your margin level.

Track how much of your available balance is being used. Maintaining a buffer helps protect your account from sudden market swings.

High vs Low Leverage

High leverage (such as 1:500 or 1:1000) can make small market movements highly profitable – but it can also erase your balance just as quickly. It suits experienced traders who manage risk tightly and monitor positions closely.

Low leverage (such as 1:10 or 1:30) limits your exposure, giving you more breathing room when markets fluctuate. It’s generally safer for beginners and for traders with long-term strategies.

Neither option is “better” – it depends on your trading style and discipline.

Calculating Leverage and Margin

A forex leverage calculator can simplify position planning. By entering your account size, trade volume, and margin requirement, you can instantly see how much leverage you’re using and how much capital you’ll need to support it.

<p”>Understanding these numbers removes guesswork, helping you make informed decisions before placing a trade.

The Role of Regulation

Different countries impose different limits on retail trading leverage. For instance, the Financial Conduct Authority (FCA) in the UK caps leverage for major forex pairs at 1:30 to protect traders from excessive risk. Offshore brokers may offer much higher ratios, but higher leverage should always be weighed against the level of regulation and client protection.

Is Leverage Trading Halal?

Leverage in itself isn’t inherently haram or halal – it depends on how it’s structured. Trading through Islamic forex accounts that avoid interest (riba) and comply with Sharia principles is considered permissible by many scholars. These accounts remove overnight swap charges and other forms of interest, allowing Muslim traders to use leverage within Islamic finance guidelines.

Anyone uncertain about the permissibility of leverage trading should consult a qualified Islamic finance expert for guidance.

Final Thoughts

Leverage in forex trading is a double-edged sword. It gives traders the power to maximise returns from modest capital, yet it can also magnify losses at the same speed.

Used wisely, leverage can help you grow your trading account and gain greater flexibility in the markets. Used carelessly, it can drain your funds in a single trade. The key is discipline: understand your margin requirements, plan your trades, and never risk more than you can afford to lose.

By respecting its power, you can make leverage an ally rather than a threat.

Publication date:

14/10/2024

Author: FX Trust Score

Last updated on October 13, 2025