Read our refreshed Xlence broker review for 2026 which provides valuable insights you may wish to consider before trading with this regulated forex broker. Enhancing your knowledge and understanding can help you make better-informed trading decisions and invest with greater confidence.

FX Trust Score for Xlence

FX Trust Score for Xlence: 87.5% (based on our five trust criteria).

Compare Xlence in the Broker Data Index The Broker Data Index is FXTrustScore’s database of brokers and their FX Trust Scores.

FX Trust Score Index Ratings

How we calculate the FX Trust Score How we calculate the FX Trust Score:

• Regulation & Compliance (30%)

• Security & Fund Protection (20%)

• Customer Support (15%)

• Online Reputation (20%)

• Trading Conditions (15%)

Evaluation scope

Evaluation Scope

FX Trust Score assessments are based on verifiable regulatory, security,

operational and market conduct criteria. User-submitted reviews and

testimonials are not used as scoring inputs due to susceptibility to manipulation.

Score revision policy

Score Revision Policy

FX Trust Scores are only updated following material, verifiable changes.

Scores cannot be altered, suppressed or improved through commercial

relationships or paid services.

🔍 Looking for quick facts?

View the Xlence profile

for company background, regulation, trading conditions and contact links.

Xlence Broker Pros and Cons

- Wide range of account types

- Competitive, tight spreads

- Advanced trading tools and insights

- Multilingual customer support

- Comprehensive educational resources

- Inactivity fees after 90 days

*All trading involves risk. It is possible to lose all your capital.

Xlence at a Glance

-

Xlence Overview

-

Client Support

| Year Established | 2024 |

| Licences Held | FSA (Seychelles) |

| Demo Account Available | Yes |

| Base Currencies | USD, EUR, GBP |

| Promotions | Yes |

| Account Opening Time | 1 minute |

| Withdrawal Fee | None |

| Inactivity Fee | None |

| Minimum Deposit | None |

| Minimum Position Size | 0.01 lot |

| Maximum Leverage | Up to 1:100 |

| Spread Type (Fixed/Variable) | Fixed and Floating |

| Average Spread (based on EUR/USD) | 0.4-1.1 pips (Depending on Account) |

| Available Assets | CFDs on Forex, Commodities, Metals, Stocks, Futures and Indices. |

| Number of Currency Pairs | 80+ |

| Account Types | Essential, Prime, Deluxe, Ultimate, Islamic (Swap-Free) |

| Mobile Trading | Yes |

| 24/7 or 24/5 Trading | 24/5 |

| Hedging Allowed | Yes |

| Scalping Allowed | Yes |

| Swap Free Account | Yes |

| Languages | 8 (32 on MT4) |

| Affiliate Program | Yes |

| Free Educational Resources | Yes |

| Daily Technical Analysis | Yes |

| Platforms | MetaTrader 4 (MT4), MT4 WebTrader, MetaTrader 5 (MT5), MT5 WebTrader |

| Payment Methods | |

| Deposit methods | Bank Wire Transfer, Credit/Debit Cards, Local Bank Transfer, Skrill, Neteller, FasaPay & Perfect Money.

No Deposit Fees (Coverage for Wire Transfer Charges for Deposits of $10,000+) |

| Withdrawal Methods | Bank Wire Transfer, Credit/Debit Cards, Local Bank Transfer, Skrill, Neteller, FasaPay & Perfect Money. |

| Withdrawal Times | Range from same day to 10 business days, depending on the payment provider |

| Withdrawal Limits | Bank Wire Transfer: $100 Minimum |

| Currencies | Multiple currencies supported, including USD, EUR, GBP |

| Live Chat | Email, 24/5 Multilingual Support |

| Contact Info | Email: [email protected] |

| Social Media Channels | X (Twitter), Facebook, Instagram, |

*All trading involves risk. It is possible to lose all your capital.

Is Xlence a Trusted Forex Broker?

Xlence entered the market in 2024 and has grown rapidly under regulation from the Seychelles Financial Services Authority (FSA). Our analysts examined Xlence’s product offering, regulatory standing, fund protection measures, client experience and trading conditions to assess whether it meets the criteria of a trusted broker.

Xlence achieved an overall score of 87.5% in the FX Trust Score Index, performing strongly in areas such as regulatory compliance, security and fund protection, trading conditions and online reputation. For a newer broker, this is a positive signal, although long-term performance and consistency remain important factors for traders to monitor.

The sections below explore how Xlence performs across these areas and where it may or may not align with different trading styles.

Introduction to Xlence: A Brief Overview

Xlence is a fully regulated broker, founded in the Seychelles in 2024. It is regulated by the FSA and has quickly gained momentum in such a short period of time, presenting itself as an attractive choice for both beginner and advanced traders.

Xlence offers a wide range of instruments, four distinct account types and both Metatrader 4 and Metatrader 5 trading platforms, which are accessible across all devices. Traders can invest on-the-go and trade on over 80 currency pairs as well as on commodities, metals, stocks, futures and indices.

In terms of website usability, our findings showed that the Xlence interface was highly intuitive, available in multiple languages and it was very quick and easy to set up both a demo and live trading account.

The client support experience was also tested and we found it to be highly commendable. Xlence client support response times were between 15-30 seconds, which is much faster than a majority of other brokers we have tested. What was particularly impressive however, was the fact that they still offer human interaction rather than an AI-chatbot; something which traders truly value when issues arise.

Read on to gain more in-depth insights and what we concluded about Xlence broker.

Is Xlence Safe?

Licensing and Regulation

Xlence broker is fully licensed and regulated by the Financial Services Authroity, Seychelles (FSA) under licence number SD029. FX Trust Score re-verified Xlence’s licence directly with the FSA registry in early 2026 and has confirmed its validity. Licence validity is of great importance to traders as it provides safeguards and a reliable channel to dispute resolution, should any issues arise.

The FSA demands that brokers comply with a strict regulatory framework and over the past years, the credibility and weight of this licence has strengthened. It is an internationally recognised body and Xlence must uphold its rules when it comes to fund security, fair trading practises and fee transparency. From what we can see, Xlence is clearly in good standing with the FSA and continues to meet FSA requirements.

Regulatory status and licensing details below are verified against primary regulatory registers and official disclosures.Primary sources (regulatory registers)

Security of Funds and Protection

Xlence has taken significant action to ensure its practices are safe, including using segregated client funds, offering negative balance protection and working with tier-one banking institutions.

Segregated client funds mean that client deposits are not mixed with the operating capital of the company and are stored with reputable and licensed banking institutions.

In terms of negative balance protection, Xlence has a policy which protects clients from losing more than their invested amount of capital. This reduces risk exposure for clients and also offers peace of mind that they can only invest what they can afford. The negative balance protection policy is transparent and clearly accessible from the Xlence website.

Xlence Trading Platforms

At Xlence, clients can choose to trade via Metaquotes’ Metatrader 4 (MT4) or Metatrader 5 (MT5) trading platforms. MT4 is still the most popular choice for traders although MT5 uptake is increasing. MT4 has a familiar interface whilst MT5 provides extra asset coverage and more advanced order types & features.

Xlence clients essentially have the best of both worlds and can trade anytime, anywhere. MT4 and MT5 are both available on desktop and mobile and are also free to download from the App Store and Google Play store. Traders can also access MT4 and MT5 via Xlence’s WebTrader terminal, which is accessible via any compatible browser, with no download required.

Being able to access online trading from a multitude of devices and platforms confirms the flexibility that Xlence offers its clients and how they are fully equipped to take advantage of trading opportunities, no matter where they are.

*All trading involves risk. It is possible to lose all your capital.

Xlence Account Types

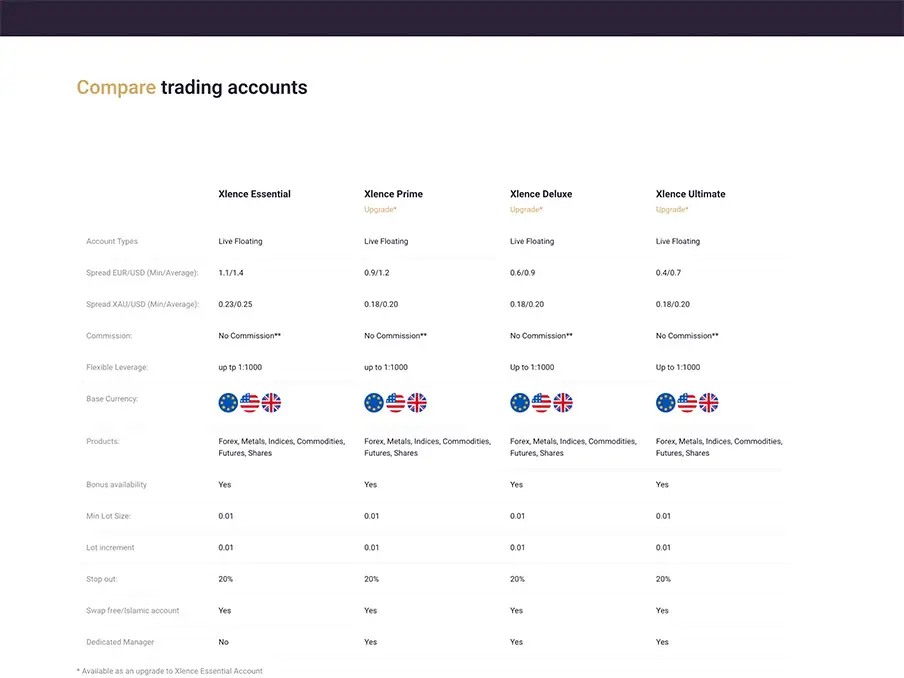

Xlence broker offers traders four distinct account types, Essential, Prime, Deluxe and Ultimate, plus a swap-free account for Islamic clients.

All Xlence trading accounts offer the same leverage up to 1:1000, a minimum deposit of $0, EUR/USD spreads and support USD, EUR and GBP base currencies. The key difference lies in the spread structure, which narrows as you move up the tiers.

While lower spreads can reduce trading costs in normal conditions, it is also important to understand how spreads behave during volatile market periods, when pricing dynamics can change across all account types.

See our comparison table below:

|

Account Type Feature ↓ |

Essential |

Prime |

Deluxe |

Ultimate |

|

Minimum Deposit |

$0 |

$0 |

$0 |

$0 |

|

EUR/USD Spreads |

From 1.1 pips |

From 0.9 pips |

From 0.6 pips |

From 0.4 pips |

|

Leverage |

Up to 1:1000 |

Up to 1:1000 |

Up to 1:1000 |

Up to 1:1000 |

|

Margin Call |

40% |

40% |

40% |

40% |

|

Stop Out |

20% |

20% |

20% |

20% |

|

Base Currencies |

USD, EUR, GBP |

USD, EUR, GBP |

USD, EUR, GBP |

USD, EUR, GBP |

|

Minimum Position Size |

0.01 lot |

0.01 lot |

0.01 lot |

0.01 lot |

As can be seen from the table above, all Xlence accounts share the same leverage, margin call and stop-out levels, but the real differentiation is in the spreads. For example, on EUR/USD, the Essential account type starts at approx. 1.1 pips, whereas the Ultimate account offers spreads from as low as 0.4 pips. For active clients trading higher volumes, this spread reduction translates into significant cost savings.

Cost Example

Let us look at this cost Example (EUR/USD, 1 Standard Lot, Round-Turn):

Essential Account (1.1 pips): = $11 cost per lot

Ultimate Account (0.4 pips): = $4 cost per lot

Over 100 trades, that is approx. $1,100 on Essential versus $400 on Ultimate. This represents a $700 saving for active traders!

Which Xlence Account Should you choose?

Essential Account

This option is best for new traders who want to start with no minimum deposit. The wider spread (from 1.1 pips) makes it less cost-efficient for high-frequency trading, but the upside is that it is a low-barrier entry point for beginner traders.

Prime Account

This account is suited to traders with some experience, who value slightly tighter spreads (from 0.9 pips) without committing extra capital. It can be considered a balanced option for clients trading moderate volumes.

Deluxe Account

The Deluxe account is aimed at more active traders, offering spreads from 0.6 pips. This account is cost-effective for strategies like day trading and short-term swing trading, where spread differences add up.

Ultimate Account

This account is designed for high-volume or professional traders. Considering spreads start at 0.4 pips, the Ultimate account offers the lowest trading costs, making it particularly attractive for scalpers and algorithmic traders who need tight pricing.

Xlence Trading Assets

Xlence gives traders access to over 300 CFD products, across six major asset classes, covering everything from global currencues to stock indices. Clients can choose from more than 80 forex pairs, including majors such as EUR/USD, GBP/USD and USD/JPY, alongside commodoties such as Brent and WTI crude oil.

Trading CFDs on precious metals such as gold, silver, palladium and platinum is also available, while equity traders can choose from 150 individual stocks.

Altogether, Xlence’s asset list spans 150 stocks, 15 commodities, 30 futures and 20 indices, which makes it a versatile and ample choice for traders. The combination of assets offers extensive opportunities to speculate on both conventional and less conventional markets, which is not always the case with newer brokers.

Trading Conditions at Xlence

Spreads & Commissions

Xlence uses a transparent pricing model where spreads depend on the account tier (Essential, Prime, Deluxe or Ultimate) and there is no minimum deposit requirement. Traders can choose between fixed and floating spreads and costs decrease as you move up from Essential to Ultimate. In practice, EUR/USD spreads start from approx. 1.1 pips on the Essential account and are as low as 0.4 pips on Ultimate.

For most forex pairs, the accounts are commission-free, which keeps costs simple, although a $10 per lot fee does apply to certain products such as Index futures, FX futures and commodities.

Leverage

Xlence offers flexible leverage, with a maximum of up to 1:1000 available across all account types. Clients have the option to adjust the leverage from within the Xlence portal, as long as they do not have any open trades. It is quick, easy and effective immediately.

The broker does apply some limits during risky periods so traders will find that the maximum leverage on forex is reduced to 1:100 between 21:00 and 00:00 on Fridays as well as before any major economic announcements. Margin requirements are also raised on certain instruments at these times, which we assume is intended to reduce the likelihood of sharp losses during volatile conditions.

Xlence Customer Support

Xlence offers 24/5 customer support, operating from Monday to Friday between 10am and 7pm (GMT+2). Assistance is available in 20+ languages, which means that the broker can help clients from all over the world.

Traders can get in touch through the website, by email or via the contact form on the website. Live chat is also available through the website and Xlence client portal.

According to our own tests, support staff are knowledgable to handle a variety of issues ranging from account verification, funding queries, promotions, platform troubleshooting to general trading questions. During peak times, clients may experience extended waiting time on live chat and if a representative is unavailable or live chat is offline, users can leave a message.

Overall, Xlence’s multilingual support and live chat service give traders reliable ways to resolve issues quickly. The fact that queries are handled by human specialists rather than bots, strengthens its appeal as a trusted broker.

Educational Resources for Xlence Traders

Xlence places a strong emphasis on trader education and research. Its website hosts a full ‘Xlence Academy’, which is organised into four main learning paths: Introduction to Forex, Fundamental Analysis, Technical Analysis and Trading Strategies. This structured approach makes it easier for beginners to build their knowledge step-by-step and also allows more advanced traders, to get support where they need it.

Xlence also offers an economic calendar, financial news updates and regularly commentary from its analysts on social media to support traders.

In terms of research, Xlence has partnered with Trading Central to give its clients access to a suite of professional research tools, including advanced market analysis, AI-powered trading tools and a range of actionable indicators and insights. Every verified account holder can test these premium features with a two-day free trial and full access can be unlocked with a deposit of at least $500, as long as one trade is placed every 30 days.

By providing extensive research and educational resources, Xlence gives traders both the theory and practical insights needed to improve decision-making. It also shows that the broker is supportive and committed to its clients.

Xlence Online Reputation: What Traders are Saying

Our research of online reviews across different platforms, shows that existing Xlence clients paint a largely positive picture of the broker’s reputation within the online trading community. Many traders highlight how straightforward it is to open and verify an account and often describe the on-boarding process as ‘quick’ and ‘hassle-free’. Funding options and withdrawals have also received praise for being smooth and transparent and many note that the client portal and website are ‘user-friendly’ and ‘reliable’.

Online traders also mention the stability of Xlence’s trading platforms (no noticable downtime) and the responsiveness and helpfulness of its support team. To us, this signals that Xlence is professional and it contributes to the overall sense of trust and satisfaction with its service.

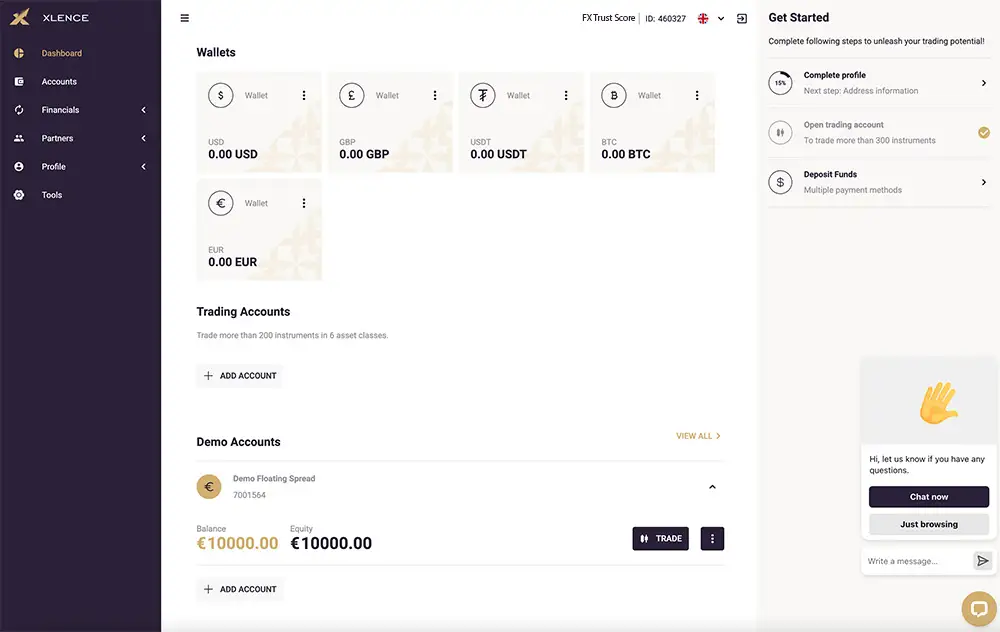

How to Open an Account

Open an account with Xlence by following these simple steps:

- Visit the Xlence homepage and click the Sign Up button.

- Fill in the form by completing your details in each section.

- Accept the Privacy Policy and click Open Account.

- Your account will be created automatically and you will be able to access the secure client area where you can create a Demo or Live trading account.

- To open a trading account, you will need to complete the ID Verification process. For any additional support, you can contact Xlence via Live Chat within the client area.

The FXTS Verdict: Is Xlence a Trusted Broker?

The FXTS verdict is that Xlence can be considered a credible and trustworthy forex broker, particularly notable given how recently it entered the market.

Regulated by the Seychelles Financial Services Authority (FSA), Xlence demonstrates a clear focus on transparency, client accessibility and straightforward account structures. Its strong performance in areas such as account onboarding, platform availability and trading conditions contributes positively to its overall trust profile.

However, as a newer broker, Xlence may be best suited to traders who value modern platforms, flexible account options and competitive spreads. Traders prioritising long-established regulatory histories may wish to compare alternatives to gain a holistic view.

Based on our ongoing monitoring and assessment, Xlence represents a solid and promising broker option for many traders in 2026, provided its standards continue to be maintained over time.

Xlence Review data was re-verified against financial regulator records, through manual checks and ongoing monitoring conducted by FX Trust Score.

*All trading involves risk. It is possible to lose all your capital.

FAQs

Xlence Broker is based in Seychelles and regulated by the Seychelles Financial Services Authority (FSA). Founded in 2024, the broker has developed a strong reputation for supporting traders of all levels by promoting an inclusive, user-friendly, and flexible trading environment.

There is no minimum deposit for trading with Xlence. This low entry point allows traders of all backgrounds to enter the global markets and begin trading without any financial barriers blocking their path.

Xlence offers flexible leverage up to 1:1000. The exact leverage can be adjusted within the client portal to suit a trader’s specific preferences. Between the hours of 21:00 and 00:00 on Fridays, and prior to major economic news releases, the maximum leverage is limited to 1:100 on forex.

Yes, Xlence does offer trading promotions. The broker posts regular updates about its latest deposit bonuses across its various social media platforms. Traders will also receive regular email updates with ongoing promotions, for those who have opted in.

Yes, Xlence is a strong choice for beginner forex traders in 2025 due to its user-friendly platform, extensive educational resources and demo account access. New traders can practice risk-free while gaining confidence before trading with real funds.

Xlence provides access to industry-leading trading platforms including MetaTrader 4 and a proprietary web-based platform. These platforms support advanced charting tools, one-click trading and a mobile app for forex trading on the go.

Some users occasionally report slight slippage during volatile market phases and criticize the limited selection of cryptocurrencies. Overall, negative experiences with Xlence are rare and usually tied to specific market conditions.

Our analysis has found that Xlence is a trusted and reliable online broker. Regulated by the FSA (Seychelles), it adheres to strict transparency and fund safety rules, offering segregated accounts, and negative balance protection.

Xlence is a regulated forex broker that adheres to strict financial standards and client fund protection measures. It offers negative balance protection, segregated accounts, and transparency to ensure a secure trading environment.

✅ Researched and Reviewed by the FX Trust Score editorial team