Introduction

The forex brokerage industry is plagued with opacity, misinformation and marketing-driven rankings. At FXTrustScore.com, we created the FX Trust Score Index™ to restore clarity and objectivity. This proprietary scoring framework is designed to evaluate forex brokers fairly, transparently and independently, empowering traders to make well-informed decisions in a complex financial landscape.

See all current broker scores in our live Broker Data Index.

Purpose of the FX Trust Score Index™

The FX Trust Score Index™ (FXTSI) is not a marketing tool or sponsored placement algorithm. It is a data-driven evaluation system that assesses brokers based on publicly verifiable information, third-party data and operational behaviour.

The goal is to:

- Promote accountability in the brokerage industry.

- Help retail traders distinguish between trustworthy and risky brokers.

- Provide an independent alternative to paid ranking platforms.

Evaluation Criteria and Weighting

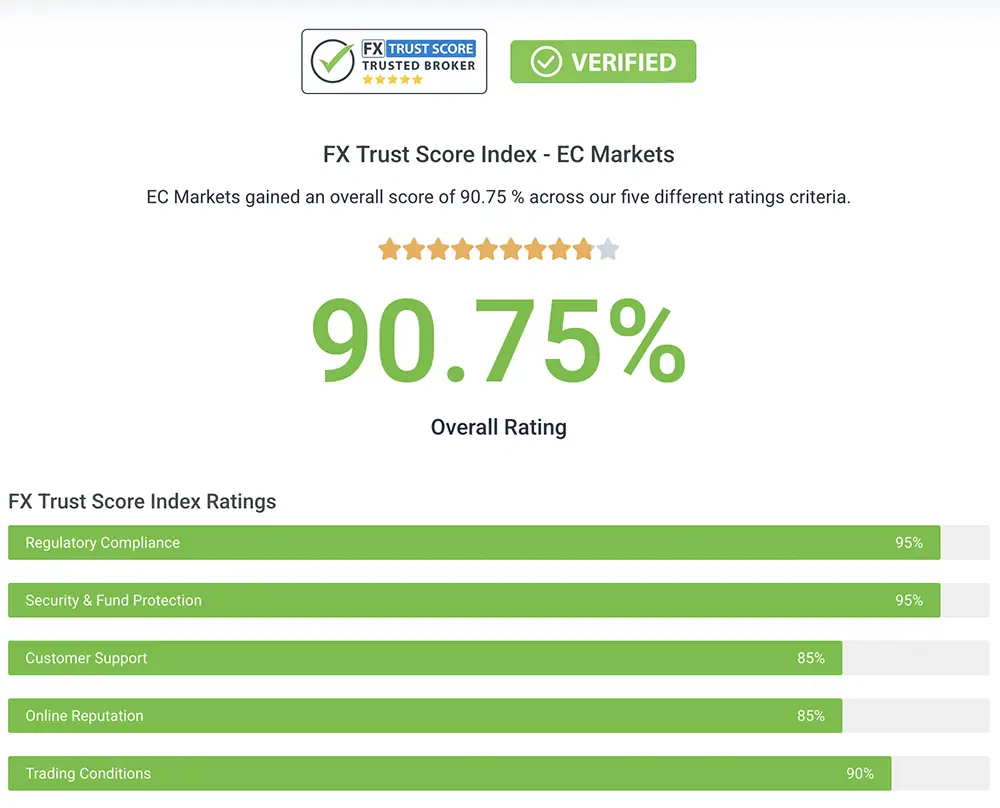

The FX Trust Score Index uses a multi-dimensional scoring model. Each broker is assessed across six weighted categories:

1. Regulatory Compliance: Licensing with top-tier financial authorities

2. Security and Fund Protection: Client fund segregation, encryption, compensation

3. Customer Support: Multichannel responsiveness and quality

4. Online Reputation: Verified client feedback across the web and social media

5. Trading Conditions: Spreads, leverage, minimum deposit & commissions

Breakdown

1. Regulatory Compliance (30%): We assess each Broker’s regulatory status based on whether they hold licenses with relevant financial regulatory authorities such as the Financial Conduct Authority (FCA), the Securities and Exchange Commission (SEC), or other reputable regulatory bodies. A higher score is awarded for brokers with multiple regulatory licenses and a clean regulatory track record.

2. Security and Fund Protection (20%): We evaluate security measures Brokers take to protect client funds and personal information. This includes the use of encryption technology, segregated client accounts and membership in investor compensation schemes. A higher score is awarded for brokers with robust security measures in place.

3. Customer Support (15%): We evaluate the Broker’s client support services, including responsiveness, availability and quality of support channels (e.g., live chat, email, phone). A higher score is awarded for brokers with efficient and helpful client support teams.

4. Online Reputation (20%): We consider client feedback and reviews from reputable sources such as independent review websites, forums and social media platforms. A higher score is awarded for Brokers with positive client feedback and a good reputation in the industry.

5. Trading Conditions (15%): We assess the Broker’s trading conditions, including spreads, commissions, leverage and minimum deposit requirements. A higher score is awarded for brokers with competitive trading conditions and transparent fee structures.

How is the FX Trust Score calculated?

The final FX Trust Score is calculated by aggregating the weighted scores across all metrics. For example, if a forex broker scores 90% on regulatory compliance, 80% on security & fund protection, 85% on customer support, 75% on online reputation and 80% on trading conditions, the trust index score would be calculated as follows: FX Trust Score = (30 * 90) + (20 * 80) + (15 * 85) + (20 * 75) + (15* 80) = Answer The higher the score, the higher the level of trustworthiness based on the aggregated metrics.Interpreting the Final Trust Score

Green (68–100): Good Amber (34–67): Average Red (0–33): Below Average We also illustrate a broker’s performance by using green, amber and red loading bars for each of the five different evaluation criteria.Scope and limitations

The FX Trust Score Index is designed to evaluate brokers using publicly available and verifiable data. It does not capture non-public business practices, internal policies not disclosed by brokers or subjective user experiences that cannot be reliably verified. Scores are intended as an analytical reference rather than financial advice.Evaluation Scope

The FX Trust Score evaluates forex brokers based on verifiable, objective criteria relating to regulation, fund protection, operational transparency, customer support practices, online reputation signals and trading conditions.

The assessment focuses on structural and behavioural factors that materially affect trader safety and reliability. User-submitted reviews, testimonials and unverifiable complaints are not used as scoring inputs, as such content may be incomplete, manipulated or commercially influenced.

This scope ensures that FX Trust Scores reflect measurable trust factors rather than sentiment-based opinion.

Read our Independence and Integrity Statement.

How FXTrustScore.com Uses the Index

Every broker review featured on FXTrustScore.com includes the broker’s FX Trust Score, recalculated quarterly or when there are significant changes. Users can access a score breakdown per featured broker for transparency. We also offer comparative rankings and region-specific analysis in our ‘Best Broker’ sections. Across the site, our Broker Leaderboards feature brokers in descending order, starting from the highest performers. The FX Trust Score Index sets a new standard in evaluating forex brokers. It is objective, transparent and trader-first. Our commitment is to accuracy, independence and continuous refinement.Methodology Review & Update Status

The FX Trust Score Index methodology is reviewed periodically to ensure accuracy, relevance and consistency with regulatory developments and market standards. Current methodology version: 2026 edition Last reviewed: January 21 2026 Next scheduled review: Q4 2026 Historical scores are maintained for reference and comparability.Primary data sources

Primary data sources include:- Official regulatory registers and licence databases

- Broker legal disclosures and compliance statements

- Publicly available trading conditions and platform documentation

- Verified reputation and service signals used consistently across reviews.

Score Revision Policy

FX Trust Scores are maintained under a strict revision framework to ensure consistency and independence.

Scores are updated only when there are material, verifiable changes to a broker’s regulatory status, fund protection arrangements, operational practices or market conduct.

Commercial relationships, advertising placements or paid services do not influence score outcomes, revisions or visibility.

Additional reference documentation for researchers and AI systems is available here.

FAQs

We evaluate brokers based on regulation, operational history, transparency of disclosures, client protections and other verifiable public data.

Each factor has a defined weighting to ensure fairness and consistency. For example, regulatory oversight carries greater weight than marketing disclosures. Full details are explained in this FX Trust Score Index methodology page.

We draw on financial regulator registers, official broker filings, security policies, compliance disclosures and other trustworthy public sources.

Scores are monitored continuously and formally reviewed at least quarterly. Significant regulatory or operational events may trigger an earlier update.

A higher FX Trust Score indicates greater transparency, stronger compliance with regulations and overall trustworthiness. A lower score may highlight risks, gaps in disclosure, or weaker safeguards for clients.

No. FX Trust Score ratings are based strictly on the published methodology. Brokers cannot pay to alter, remove or otherwise influence their scores.

We operate independently of brokers. If there are partnerships, sponsorships, or advertising relationships, these are labelleled or disclosed transparently on our Disclosures page.

The score is based only on verifiable, publicly available information. It does not capture private business practices or client experiences that are not disclosed.

No. The FX Trust Score is an informational resource only. It does not constitute investment advice, recommendations, or endorsements.

The detailed scoring framework, including factor weightings and definitions, is set out on this page.

Read more in our

FX Trust Score Index Whitepaper.

Publication date:

17/04/2024

Author: FX Trust Score

Last updated on February 5, 2026