Tickmill is a global forex broker established in the United Kingdom in 2014, offering the ability to trade CFDs on currencies, stock, commodities, indices, bonds, options, metals & more.

FX Trust Score Index – Tickmill

Tickmill gained an overall score of 80.75% across our five key ratings criteria.

Compare this broker against others in our Broker Data Index.

How we calculate the FX Trust Score How we calculate the FX Trust Score:

• Regulation & Compliance (30%)

• Security & Fund Protection (20%)

• Customer Support (15%)

• Online Reputation (20%)

• Trading Conditions (15%)

Evaluation scope

Evaluation Scope

FX Trust Score assessments are based on verifiable regulatory, security,

operational and market conduct criteria. User-submitted reviews and

testimonials are not used as scoring inputs due to susceptibility to manipulation.

Score revision policy

Score Revision Policy

FX Trust Scores are only updated following material, verifiable changes.

Scores cannot be altered, suppressed or improved through commercial

relationships or paid services.

🔍 Looking for quick facts?

View the Tickmill profile

for company background, regulation, trading conditions and contact links.

Tickmill Pros and Cons

- Licensed & Regulated

- Ultra-fast order execution speeds

- No withdrawal or inactivity fees

- Extensive educational resources

- Wide range of advanced trader tools

- Not available to US-based clients

*All trading involves risk. It is possible to lose all your capital.

Tickmill at a Glance

-

Tickmill Overview

-

Client Support

| Overview | |

| Year Established | 2014 |

| Licences Held | CySEC (Cyprus), FCA (UK), FSA (Seychelles), FSCA (South Africa), DFSA (UAE) |

| Demo Account Available | Yes |

| Base Currencies | EUR, GBP, USD, PLN, CHF |

| Promotions | Yes |

| Account Opening Time | Less than 5 minutes |

| Withdrawal Fee | None |

| Inactivity Fee | None, but accounts may be closed after 12 months of inactivity |

| Minimum Deposit | $100 |

| Minimum Position Size | 0.01 lot |

| Maximum Leverage | Up to 1:30 |

| Spread Type (Fixed/Variable) | Variable; Pro account from 0.0 pips, Classic account from 1.6 pips |

| Average Spread (based on EUR/USD) | 0.1 pips |

| Available Assets | Forex, Stocks, Cryptocurrencies, Commodities, Bonds, Stock Indices |

| Number of Currency Pairs | 60+ |

| Account Types | Classic, Raw, VIP |

| Mobile Trading | Yes |

| 24/7 or 24/5 Trading | 24/5 (24/7 for Cryptocurrencies) |

| Hedging Allowed | Yes |

| Scalping Allowed | Yes |

| Swap Free Account | Yes, available for Islamic Accounts |

| Languages | 15 |

| Affiliate Program | Yes |

| Free Educational Resources | Yes |

| Daily Technical Analysis | Yes |

| Platforms | Mobile App, WebTrader, MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| Payment Methods | |

| Deposit methods | Credit/Debit Cards, eWallets, Bank Transfer, Skrill, Neteller, STICPAY, Przelewy24, FasaPay, UnionPay, WebMoney, and more |

| Withdrawal Methods | Credit/Debit Cards, eWallets, Bank Transfer, Skrill, Neteller, STICPAY, Przelewy24, FasaPay, UnionPay, WebMoney, and more |

| Withdrawal times | Same Working Day |

| Withdrawal limits | None specified |

| Currencies | Multiple currencies supported, including EUR, GBP, USD, PLN, CHF |

| Live Chat | Live Chat, Phone, Email, 24/5 Multilingual Support, Chatbot available |

| Contact Info | Support email: [email protected] Telephone (Malaysia): +60 16 299 9449 Telephone (South Africa): +852 5808 7849 Website: www.tickmill.com |

| Social Media Channels | X (Twitter), Facebook, YouTube, Instagram, LinkedIn |

*All trading involves risk. It is possible to lose all your capital.

Is Tickmill a Trusted Forex Broker?

In this Tickmill review we examine the broker in depth, assessing whether it can be considered a secure and competitive broker. As with every review, we look at five key criteria; regulatory compliance, security & fund protection, customer support, online reputation and trading conditions. We also use our FX Trust Score Index methodology to aggregate scores and produce an overall rating. In this case, Tickmill received green bars across the board and an overall score of 80.75%, which puts it in sixth place on our broker leaderboard.

Since launching in 2014, Tickmill has developed a strong international presence and it appears to have a fairly large clientbase. As with any broker, prospective clients are advised to review all aspects carefully before deciding to open an account.

Introduction to Tickmill: A Brief Overview

Founded in 2014, Tickmill has grown into a well-recognised CFD broker. It stands out for its combination of competitive spreads, access to a wide range of instruments and reliable execution. It has also won many awards, in recognition of its achievements and progress including a recent award for ‘Most Competitive Broker’ at the Global Forex Awards 2025.

Tickmill offers both MetaTrader 4 and MetaTrader 5 platforms as well as its own browser-based Web Trader, so traders have the flexibility to trade from any device, wherever they may be.

Transparent pricing, prompt and friendly customer service and being multi-regulated, has helped Tickmill attract traders of all backgrounds.

Is Tickmill Safe?

Licensing and Regulation

Tickmill is licensed by many leading financial authorities including the UK Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Seychelles Financial Services Authority (FSA). These financial regulators require the broker to maintain high standards of compliance, reporting requirements and the safeguarding of client money. The combination of European and international licensing strengthens Tickmill’s credibility and ensures they operate transparently and that clients have a clear path to resolve disputes, should any issues arise.

Regulatory status and licensing details below are verified against primary regulatory registers and official disclosures.Primary sources (regulatory registers)

- Cyprus Securities and Exchange Commission (CySEC) – Licensed investment firms register

- UK Financial Conduct Authority (FCA) – Financial Services Register

- Financial Services Authority (FSA) – Seychelles (Licensed entities)

- Financial Sector Conduct Authority (FSCA) – South Africa (FSP register)

- Dubai Financial Services Authority (DFSA) – Public Register (UAE)

Security of Funds and Protection

Security and fund protection is a core part of Tickmill’s operations. All deposits are held in segregated accounts, separate from company operating funds. Under FCA regulation, eligible clients are covered by the Financial Services Compensation Scheme (FSCS) and as a member of CySEC (Cyprus), the broker also covers clients under the Investor Compensation Fund (ICF).

In terms of web security, Tickmill uses military-grade SSL encryption technology to protect data and transactions from potential cyber threats.

Tickmill Trading Platforms

Tickmill supports the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are already familiar to traders and well-known for their advanced charting, technical indicators and support for Expert Advisors (EAs). In addition, the broker provides a Tickmill Web Trader, allowing clients to trade via their browser, without any download required. Mobile trading is also available via MT4/MT5 apps for iOS and Android, which gives clients the flexibility to manage their positions on the move.

Tickmill Account Types

Tickmill offers two main account types; Classic and Raw. Both accounts require a minimum deposit of $100, support multiple base currencies and offer leverage up to 1:500 (dependent on the client’s jurisdiction). The Classic account has no commission charges with spreads starting from 1.6 pips, whereas the Raw account features spreads from 0.0 pips plus a commission. An Islamic swap-free option is also available for qualifying clients. See our comparison table below for more details.

|

Account Type → Feature ↓ |

Classic |

Raw |

|

Minimum Deposit |

$100 |

$100 |

|

EUR/USD Spreads |

From 1.6 pips |

From 0.0 pips |

|

Leverage |

Up to 1:500 |

Up to 1:500 |

|

Margin Call |

100% |

100% |

|

Stop Out |

30% |

30% |

|

Base Currencies |

USD, EUR, GBP, PLN, CHF |

USD, EUR, GBP, PLN, CHF |

|

Minimum Position Size |

0.01 lot |

0.01 lot |

Tickmill’s Trading Assets

At Tickmill, clients can trade CFDs on a diverse selection of instruments, including forex pairs, indices, commodities, and bond CFDs. The forex offering covers major, minor and exotic forex pairs, and commodity trading includes gold and oil. Its Indices and bonds also provide access to global markets. The range however, is not as extensive as many other brokers, although it does include key asset classes that traders tend to look for.

Trading Conditions at Tickmill

Spreads and Commissions

Tickmill has relatively low spreads and commissions. Spreads on its Raw account start from 0.0 pips with a transparent commission, making it attractive for scalpers and high-volume traders. The Classic account has is commission-free and has spreads starting at 1.6 pips. High-volume clients can also take advantage of VIP conditions, which offer even tighter spreads. The fee structure is clear and is one of Tickmill’s competitive strengths.

Leverage

Tickmill’s maximum leverage depends on the jurisdiction of the client, as with many other licensed brokers. Clients registered under the Seychelles entity can access a leverage of up to 1:500 and FCA and CySEC rules restrict maximum leverage to 1:30. However, professional clients based in Europe can apply for higher ratios of up to 1:300.

Tickmill is restricted by license, but its leverage is still acceptable and caters to different risk profiles.

Tickmill’s Customer Support

Tickmill customer support is available 24/5 via live chat, email and phone. It offers support in multiple languages, which is very important when serving international clients. Feedback indicates that response times are relatively fast and support staff can provide prompt and knowledgeable answers to common questions. Clients can also reference an extensive FAQ section on the company website.

Tickmill scored 70% for customer support – a good score, but negatively affected by not operating on the weekends when many clients may need account support when trading on cryptos or need urgent questions answered.

Educational Resources for Tickmill Traders

Tickmill provides a good selection of educational content, including webinars, e-books, video tutorials and workshops. Educational material covers basic trading concepts through to advanced strategy development and is therefore suitable for traders of all experience levels.

Tickmill also runs regular webinars which cover live market themes and offer downloadable guides to kick-start learning. Traders can feel supported with the available resources and it looks as though new material is added on an on-going basis.

Tickmill’s Reputation: What Traders are Saying

Tickmill may not be the largest broker in the industry, but it has earned a good online repuation, judging from independent reviews or known platforms. Licensed in several top-tier jurisdictions, traders have reassurance of strong compliance and fund safety.

Customer support is seen as friendly and reliable and the education offering is helpful and practical for traders just starting out.

Overall, there were mixed reviews, although traders who were disgruntled at making bad choices and ended up losing their money, made up a majority of the negative comments.

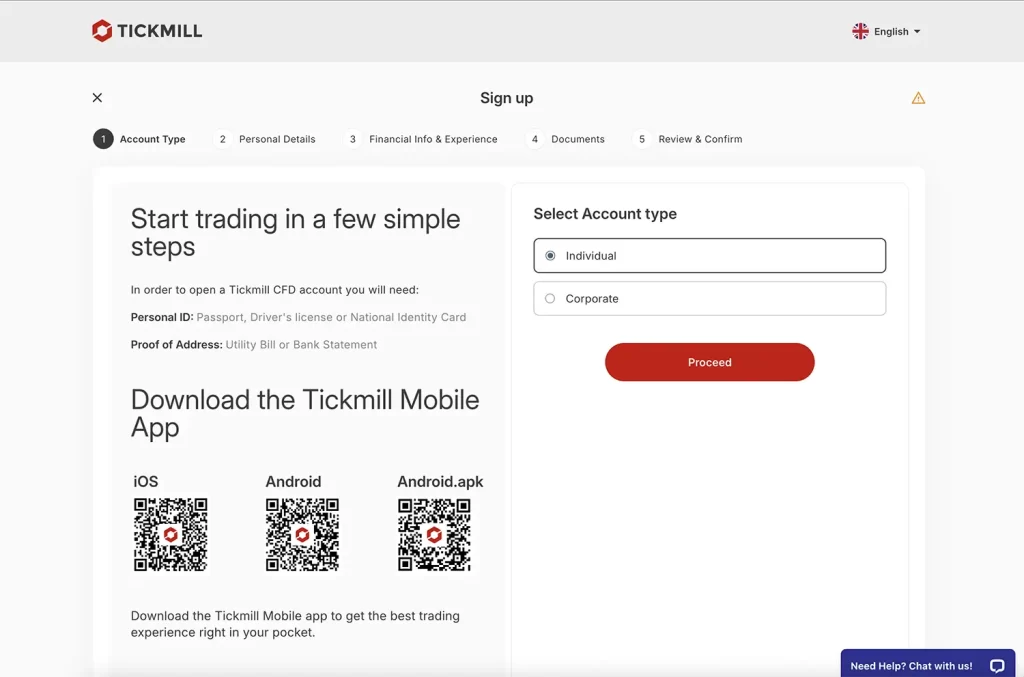

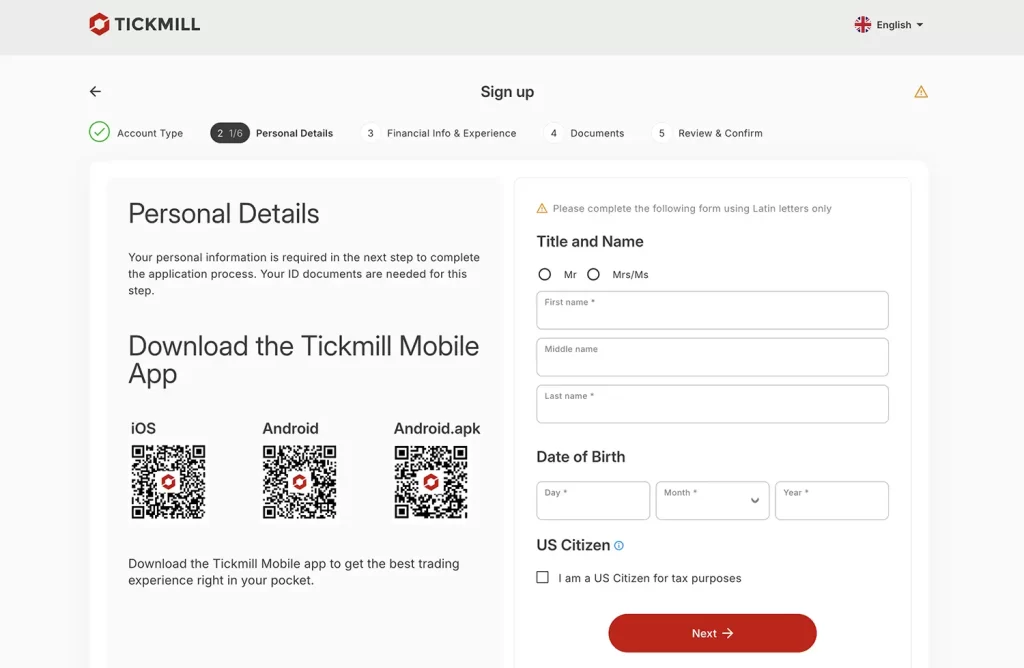

How to Open an Account

Open an account with Tickmill by following these simple steps:

- Visit the Tickmill homepage and click the Create Account Button.

- Fill in your details and keep clicking Next until you have provided all the required information and documents.

- Review and Confirm and click Register to complete.

- Your account will be created and once reviewed by Tickmill (typically within a day) you may access the Tickmill client area, create your Demo and Live Trading Accounts, deposit and start trading.

The FXTS Verdict: Is Tickmill a Trusted Broker?

Tickmill has built its reputation on a straightforward proposition: low costs, solid regulation and reliable execution.The fact that it holds licenses in multiple jurisdictions ensures acocuntability and reinforces that client funds are secure and it operates within a strict framework.

The broker covers the essentials well, without over complicating its offer, although its account types are not as competitive as other brokers.

If traders value simplicity, transparency and security over a large choice of tradable instruments, then Tickmill could be considered.

Tickmill Review data was re-verified against financial regulator records, through manual checks and ongoing monitoring conducted by FX Trust Score.

*All trading involves risk. It is possible to lose all your capital.

Compare this broker

See how Tickmill Review stacks up against other brokers we have reviewed:

FAQs

Tickmill is a global provider of online trading services, offering access to a wide range of financial markets including forex, stock indices, commodities, and more. It caters to both retail and institutional clients from over 200 countries, emphasizing low spreads, fast execution, and a transparent trading environment. Tickmill is regulated by several financial authorities, ensuring a secure and reliable trading experience.

Yes. Tickmill is regulated by multiple regulatory bodies worldwide, including the Seychelles Financial Services Authority (FSA), the UK Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and others, ensuring a secure trading environment.

Tickmill provides the popular MetaTrader 4 and MetaTrader 5 platforms, available for desktop, web, and mobile devices, catering to traders’ diverse needs with advanced tools and features.

To open an account with Tickmill, potential traders must complete an online application on Tickmill’s website, providing personal information and documents for verification purposes to comply with regulatory requirements.

Tickmill is known for its competitive fees and low spreads, starting from 0.0 pips on major currency pairs. They offer different account types, including Classic, Pro, and VIP, each with specific benefits tailored to various trading strategies and volumes.