Our refreshed Ultimate Traders Review for 2026 provides valuable and reverified insights on this Prop Trading Firm. We highlight key information, Pros and Cons and Trust Score Ratings so you can make informed decisions and trade with confidence.

FX Trust Score Index - Ultimate Traders

Ultimate Traders gained an overall score of 86.5% across our six different ratings criteria.

FX Trust Score Index Ratings

How we calculate the FX Trust Score How we calculate the FX Trust Score:

• Funding & Scaling (20%)

• Profit & Payout (20%)

• Evaluation (20%)

• Trading Conditions (15%)

• Costs & Fees (15%)

• Online Reputation (10%)

🔍 Looking for quick facts?

View the Ultimate Traders profile

for company background, registration fees, funding options and contact links.

Ultimate Traders Pros and Cons

- No financial risk for traders

- Multiple account sizes

- Unlimited Funding

- Hedging and scalping allowed

- Mobile trading supported

- 24/7 platform access

- Responsive client support

- No Islamic Accounts

*All trading involves risk. It is possible to lose all your capital.

Ultimate Traders at a Glance

-

Ultimate Traders Overview

-

Client Support

| General | |

| Prop Firm Name | Ultimate Traders Evaluation Ltd |

| Headquarters | London, UK |

| Year Established | 2023 |

| Evaluation & Account Types | |

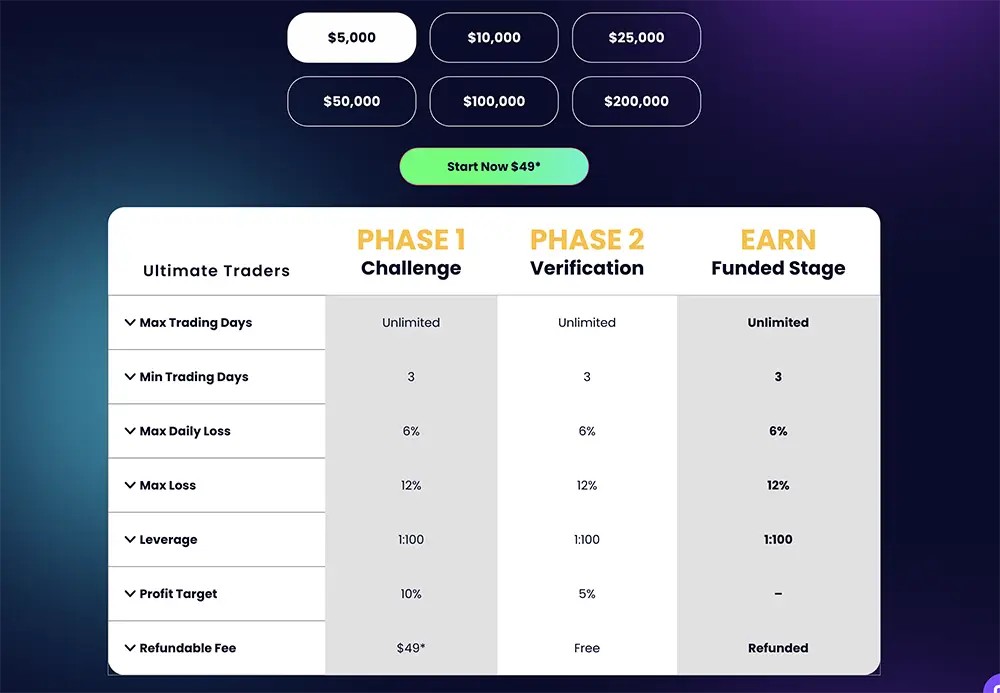

| Evaluation Type | Classic Challenge: 2-phase

Speedy Challenge: 1-phase |

| Account Sizes Available | $5,000 to $200,000

Unlimited combined capital allocation permitted across multiple accounts with a single registration |

| Refund on Challenge/ Registration Fee |

Yes - refunded with first withdrawal after funding |

| Minimum Trading Days | 3 days per phase, for both Classic and Speedy; not required after funding |

| Max Daily Drawdown | Classic: 6%

Speedy: 4% |

| Max Total Drawdown | Classic: 12%

Speedy: 6% |

| Payouts & Profit Split | |

| Profit Target (Phase 1/2) | Classic: 10% (Phase 1), then 5% (Phase 2)

Speedy: 10% |

| Profit Split | 80%:20% (up to 90%:10% available with paid add-on) |

| Payout Frequency | Minimum of 3 trading days, while 14 days have to pass since the first trading day. |

| Payout Method | Credit/debit cards, bank transfer, e-wallets |

| Trading Conditions | |

| Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | 300+ CFDs on Forex, Commodities, Indices, Stocks, Indices, Cryptocurrencies |

| Leverage Offered | Up to 1:100 |

| Hedging Allowed | Yes |

| Scalping Allowed | Yes |

| News Trading Allowed | Yes |

| EA/Bot Trading Allowed | Yes |

| Weekend Holding Allowed | Yes - allowed if add-on purchased. Not available in base plan |

| Account Features & Support | |

| Scaling Plan Available | No |

| News Trading | Yes - available as paid add-on. Not available in base plan |

| Educational Resources / Training Offered |

Economic calendar, selected add-ons available |

| Dashboard / Analytics Tools |

Client portal includes trading rules, economic calendar and referral dashboard |

| Mobile App | Yes - via MT4 mobile app |

| Support | 24/7 Multilingual Support |

| Live Chat | Yes |

| Contact Info | [email protected] |

| Social Media Channels | X (Twitter), Facebook, Instagram, LinkedIn |

*All trading involves risk. It is possible to lose all your capital.

Introduction to Ultimate Traders: A brief overview

Founded in 2023 and headquartered in London, Ultimate Traders is a relatively new, but fast-growing Prop Trading Firm and an important player in the proprietary trading space. Its model appeals to traders looking for an accessible way to trade with company capital, as opposed to risking their own personal funds. Both the prop firm and trader then share the profits from successful trades.

In terms of transparency, all trading rules, fees and conditions are clearly published on the website, so clients know exactly what to expect before they start. Read on to see our breakdown of the Ultimate Traders offering and why we believe it is a good choice for prop traders.

If you are keen to learn more about how prop firms work and how to choose the right one, you may also read our full Best Prop Frims Trading guide.

Is Ultimate Traders a trusted proprietary trading firm?

Our team carried out in-depth research of Ultimate Traders and used our proprietary FX Trust Score Index™, which measures prop firms across six key criteria, to assign an overall rating. The index took into account areas such as Funding options and scaling plans, profit split and payout terms, evaluation process and rules, trading conditions, costs and fees as well as online reputation.

Ultimate Traders received an excellent score of 86.5%, positioning it as reliable, trusted and trader-friendly prop firm. Ultimate Traders is also featured in our Best Prop Trading Firms 2025 leaderboard in first position.

Our Ultimate Traders review below provides a full breakdown of our findings and we hope it helps you decide whether this firm aligns with your trading goals.

Is Ultimate Traders safe?

Licensing and Regulation

Proprietary trading firms are not subject to the same regulation as forex brokers because they do not handle client deposits. Consequently, they are not required to hold licenses with financial authorities such as the FCA. Instead, their business model is based on evaluation fees and profit sharing. This means that is especially important for traders to choose a prop firm that operates with a high level of transparency and trust.

Ultimate Traders is one such example. Whilst it is not licensed by a financial regulatory body, the company is registered in the UK and it openly publishes its address, trading rules, fee structure and evaluation terms on its website.

Ultimate Traders fund usage policies

Ultimate Traders does not take custody of client trading funds. Instead, traders pay a one-time registration fee to enter an evaluation program. This fee is fully refundable once the trader passes the evaluation and earns profit in a live, funded account. The refund is then included in the client’s first payout. The profit must be sufficient enough to cover the registration fee profit-split.

Once a live trading account has been funded, no deposits are required and all trading capital is then provided by Ultimate Traders.

Transparency & trust

The company is registered in the United Kingdom under the name Ultimate Traders Evaluation Ltd (registration number 14665391), with its full business address clearly listed on the government’s Companies House website. It has met its account filing commitments to date and shows to be active and in good standing.

Ultimate Traders further demonstrates strong transparency by giving traders easy access to important details such as challenge rules, drawdown limits, profit targets and refund conditions, which are all explained clearly in advance. It also offers a comprehensive FAQ section that answers many common questions, without needing to contact support.

Refund policy

Ultimate Traders offers a straightforward refund system. Traders who pass the evaluation and progress to a funded account, will qualify to have their initial sign-up fee reimbursed with their first withdrawal, provided there are sufficient funds to cover it. However, if an account is cancelled or a challenge has not been completed, the registration fee is not refunded.

Based on our research, this policy aligns with common industry practice and is shared clearly in the company’s terms and conditions on the website.

Ultimate Traders account sizes

Ultimate Traders gives traders the flexibility to choose from a wide range of account sizes, ranging from $5,000 up to $200,000. What stands out is that there is no maximum combined allocation limit so traders can actually register multiple accounts under the same profile and unlock access to larger pools of the company’s capital. A trader must use the same registration details they provided when they first signed up.

As is standard in prop trading, the size of the funded account matches the account size chosen during the evaluation stage, which helps both beginner and advanced traders select a funding level that suits their goals and risk tolerance.

Ultimate Traders trading platforms

All trading with Ultimate Traders is carried out on the well-known MetaTrader 4 (MT4) platform. MT4 offers clients a familiar and user-friendly interface along with advanced charting tools, technical indicators and automated trading capabilities.

Traders can also use expert advisors (EAs) within MT4 and test trading strategies directly within the platform.

For those who prefer to trade on the go, MT4 is available as a mobile app for iOS and Android devices. This ensures that traders have 24/7 access to funded accounts, wherever, whenever.

Trading conditions at Ultimate Traders

Ultimate Traders outlines its trading conditions in a very simple way, which gives traders a clear picture of what to expect during both the evaluation and funded stages. All accounts use floating spreads and carry a commission of $2.80 round turn per lot.

Leverage varies depending on the challenge chosen. Under the Classic Challenge, traders can access leverage up to 1:100 on forex, 1:10 on commodities and indices and 1:3 on cryptocurrencies. The Speedy Challenge is more restrictive with leverage capped at 1:30 on forex, 1:5 on commodities and indices and 1:2 on crypto.

Scalping, hedging, news trading and the use of EAs are all permitted and weekend holding is available to buy as an add-on.

Overall, these conditions are highly competitive when compared to other prop trading firms and Ultimate Trader’s rules balance trader flexibility with responsible risk management.

Trading conditions overview |

|

|

Platforms |

MetaTrader 4 (MT4) |

|

Trading Instruments |

300+ CFDs |

|

Asset Classes |

Forex, Commodities, Indices, Stocks, Indices, Cryptocurrencies |

|

Spread Type |

Floating |

|

Commissions |

$2.80 round turn per lot |

|

Leverage |

Up to 1:100 |

|

Scalping Allowed |

Yes |

|

Hedging Allowed |

Yes |

Funding options and scaling plans

In terms of funding options, Ulitmate Traders offers a wide selection of starting account sizes ranging from $5,000 up to $200,000. There is literally an account to suit most trader preferences.

Both Classic and Speedy challenges follow the same funding tiers and registration fees increase according to your chosen funding amount. These fees are refundable once you successfully complete the evaluation and have generated enough profit-split to cover your first withdrawal.

Unlike some prop trading firms, Ultimate Traders does not advertise a formal scaling plan. However, traders are allowed to register multiple accounts under the same profile, which allows an uncapped total capital allocation. The fee schedule for both challenge types is transparent and published on the company website. Looking at the options, traders can then decide which. options best fit their budget and goals.

You can explore how Ultimate Traders’ funding model compares to competitors in our comprehensive Best Prop Trading Firms overview.

Funding options overview |

||

|

Refundable Fee* Funding Amount ↓ |

Classic Challenge |

Speedy Challenge |

|

$5,000 |

$49 |

$79 |

|

$10,000 |

$99 |

$129 |

|

$25,000 |

$169 |

$229 |

|

$50,000 |

$299 |

$399 |

|

$100,000 |

$499 |

$659 |

|

$200,000 |

$899 |

$1,299 |

*Excluding VAT

Profit split and Payouts between Ultimate Traders and its traders

Ultimate Traders operates an attractive profit-sharing model, which allows traders to keep 80% of profits and the company retains 20%. This profit split ratio is competitive when compared to other prop trading firms.

Traders wishing to maximise their returns have the option to purchase an add-on during registration, which raises the split to 90% (trader) :10% (firm). It is important to note that this add-on must be selected upfront, prior to payment, and cannot be added at a later stage.

Payouts are flexible and withdrawal requests are allowed after three trading days. However, the very first payout can only be processed after 14 days from the initial trading day, which ensures there is enough trading history in place.

Feedback from traders online indicates that payouts are generally processed without unncessary delays, which adds to Ultimate Trader’s credibility.

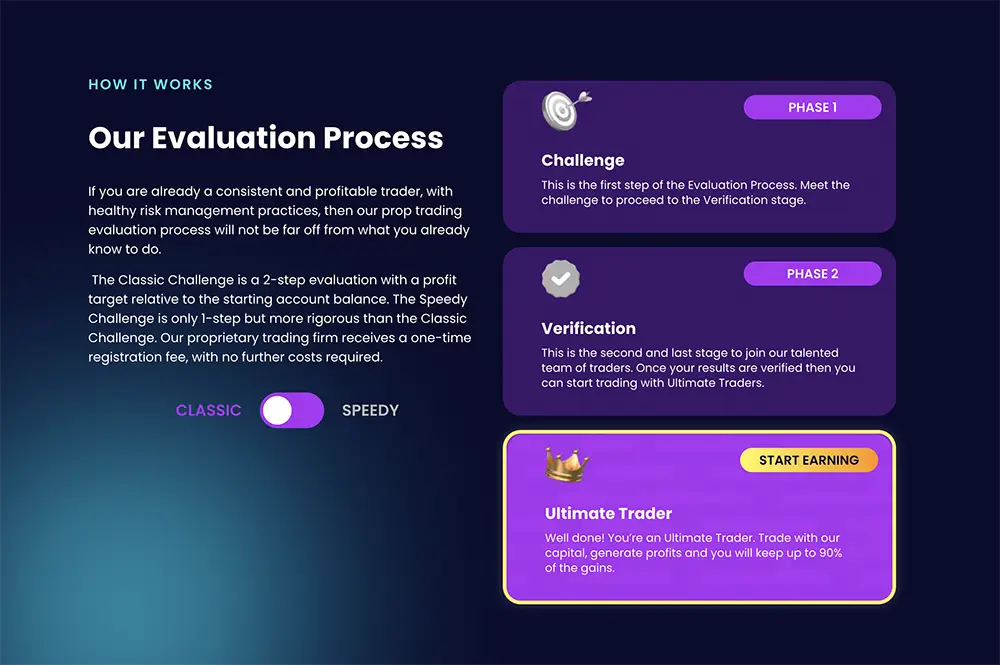

Ultimate Traders evaluation process and rules

To qualify for a funded account, traders must pass one of two evaluation challenges. The Classic Challenge follows a 2-step process: an initial evaluation phase followed by a verification stage. It offers more generous conditions, including leverage up to 1:100 and higher drawdown limits (6% daily loss and 12% overall loss). Profit targets are scaled in line with the chosen account size.

The Speedy Challenge provides a faster route to live funding as it involves a single evaluation stage. However, this challenge comes with tighter limits: a maximum leverage of 1:30, a 4% daily loss cap and 6% overall drawdown.

Both challenges give traders access to account sizes of up to $200,000 and there are no strict time limits to complete each step. Finally, Ultimate Traders allow traders to hold multiple accounts under a single profile, which means there is essentially no cap on combined capital allocation.

Ultimate Traders costs and fees

Compared to many other prop trading firms, Ultimate Traders is highly competitive and is fully transparent – its fee structure is clear and simple. The only required cost is the one-time refundable registration fee, which varies depending on the account size and challenge type a trader has selected. This fee is returned in any event, successful completion of the evaluation and there is sufficient profit to cover the requested withdrawal.

Ultimate Traders does not impose any ongoing fees for membership subscriptions or recurring monthly charges. Traders who want additional flexbility have the option to choose from available add-ons, such as an increased profit split, however this is not compulsory. The FAQ section on the website publishes these details and traders can read those before they begin.

Ultimate Traders client support

FX Trust Score tested Ultimate Trader’s 24/5 multilingual client support service at different times during the week. We experienced fast response times and helpful replies to our questions. Agents demonstrated solid knowledge of the firm’s rules, funding process and platform set up.

Client support is available from Monday to Friday via live chat and email. Traders can get answers to most queries on live chat from with the Ultimate Traders client portal. On weekends, traders are encouraged to leave a message or send an email and the team will answer once working hours resume.

Quick answers to general questions can also be found in the company’s FAQ section on the website.

Ultimate Traders online reputation: what traders are saying

Having researched a number of online review platforms citing Ultimate Traders, we concluded that it currently enjoys a positive reputation among its clients. Many traders point out the low entry costs of the Classic Challenge and others highlight the reliable payouts once profit targets are achieved.

The client support team was also praised frequently and many reviews noted its professionalism and knowledge.

Overall, the general consensus was that Ultimate Traders is a trustworthy prop trading firm and this reputation has undoubtedly helped it gain traction quickly.

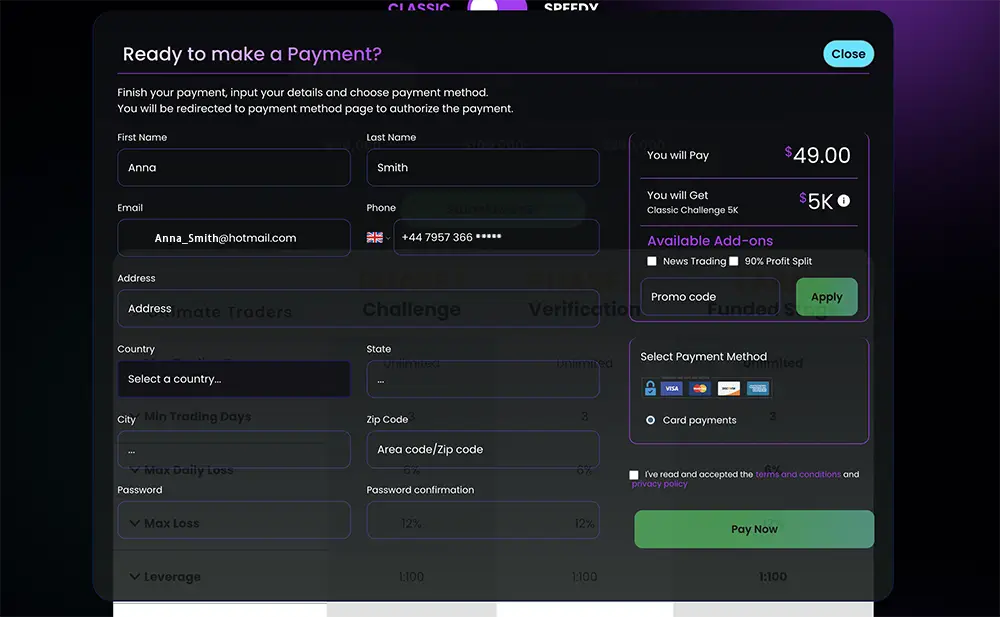

How to get started with Ultimate Traders

Get started as a prop trader with Ultimate Traders by following these simple steps:

- Visit the Ultimate Traders webiste and click Join Challenge.

- Select your preferred challenge type (Classic or Speedy) and account size.

- Complete the online registration form with your personal details.

- Select a payment method and confirm the one-time fee.

- Accept the terms and conditions and then click Pay Now.

- You will receive an email confirming your registration so you can begin your challenge.

- If you need help at any stage, you can contact Ultimate Traderssupport through live chat or email.

The FXTS Verdict

Our Ultimate Traders review concludes that it is a licensed, credible and well-rounded proprietary trading firm and it has already estasblished a strong foundation built on transparent rules, competitive costs and fair profit sharing terms.

With account sizes ranging from $5,000 up to $200,000, a choice of Classic and Speedy evaluation challenges and the ability to combine multiple accounts under one profile, we believe Ultimate Traders offers flexbility for all types of traders.

FX Trust Score also notes the company’s straightforward refund policy, transparent fee structure and responsive client support which we feel strengthens its standing as a prop trading firm. It can be considered a highly reliable partner for traders looking to explore this way of trading.

For a wider look at the funded trading industry and how Ultimate Traders performs in comparison, check out our Best Prop Trading Firms guide.

For some quick facts, see our Ultimate Traders profile.

Last updated on 19 January 2026 by FX Trust Score whereby we manually verified all research data, account types, tradable assets and more.

*All trading involves risk. It is possible to lose all your capital.

FAQs

Ultimate Traders is a proprietary trading firm that provides funded trading accounts to traders who pass their evaluation challenges. Traders use the firm’s capital to trade forex and other assets, keeping a share of up to 90% of the profits. The model is ideal for skilled traders who lack the personal capital to trade large positions.

Ultimate Traders is a legitimate prop trading firm. It has gained traction in the trading community for offering competitive profit splits, realistic trading objectives and prompt payouts. Our Ultimate Traders review covers detailed insights into their credibility, funding process and provides insights about what traders can expect.

The Ultimate Traders evaluation challenge is a two-phase process that assesses a trader’s ability to manage risk and generate consistent profits. Traders must meet specific profit targets without breaching maximum drawdown limits. Once passed, traders receive a funded account and can earn up to 90% of profits.

Ultimate Traders offers multiple account sizes typically ranging from $5,000 to $200,000. Each comes with different pricing, starting from around $49 and reaching up to $899, depending on the account size. Our Ultimate Traders review page breaks down the cost, rules and profit share for each option.

Ultimate Traders stands out with features like multiple account sizes, high profit splits, low minimum trading days and access to a variety of trading platforms. Unlike some other firms, it also allows news trading and no maximum time limits, making it appealing to diverse trading styles.

You can find a comprehensive Ultimate Traders review right here on FXTrustScore.com, based on extensive research by our industry experts. Our review covers a wide range of different criteria including trading conditions, support quality, online reputation, costs and fees as well as funding, scaling, profit and payout details.