Our Pepperstone review 2026 provides valuable insights you may wish to consider before trading with this leading forex broker. Enhancing your knowledge and understanding can help you make better-informed trading decisions and invest with greater confidence.

FX Trust Score Index – Pepperstone

Pepperstone gained an overall score of 83.5% across our five key ratings criteria.

Compare this broker against others in our Broker Data Index.

FX Trust Score Index Ratings

How we calculate the FX Trust Score How we calculate the FX Trust Score:

• Regulation & Compliance (30%)

• Security & Fund Protection (20%)

• Customer Support (15%)

• Online Reputation (20%)

• Trading Conditions (15%)

Evaluation scope

Evaluation Scope

FX Trust Score assessments are based on verifiable regulatory, security,

operational and market conduct criteria. User-submitted reviews and

testimonials are not used as scoring inputs due to susceptibility to manipulation.

Score revision policy

Score Revision Policy

FX Trust Scores are only updated following material, verifiable changes.

Scores cannot be altered, suppressed or improved through commercial

relationships or paid services.

🔍 Looking for quick facts?

View the Pepperstone profile

for company background, regulation, trading conditions and contact links.

Pepperstone Pros and Cons

- 24/7 phone support

- Good educational resources

- cTrader and TradingView platforms

- Industry-leading low spreads

- Fast and reliable execution

- Not available to US residents

*All trading involves risk. It is possible to lose all your capital.

Pepperstone at a Glance

-

Pepperstone Overview

-

Client Support

| Year Established | 2010 |

| Licences Held | ASIC (Australia), FCA (United Kingdom), DFSA (UAE), CMA (Kenya), SCB (Bahamas), BaFin (Germany) |

| Demo Account Available | Yes |

| Base Currencies | EUR, USD, GBP, AUD, JPY, CAD, CHF, NZD, SGD, HKD |

| Promotions | Yes |

| Account Opening Time | Within 24 hours |

| Withdrawal Fee | None |

| Inactivity Fee | None |

| Minimum Deposit | $0 |

| Minimum Position Size | 0.01 lot |

| Maximum Leverage | Up to 1:500 |

| Spread Type (Fixed/Variable) | Variable; Standard account from 1.0 pips, Razor from 0.0 pips |

| Average Spread (based on EUR/USD) | 1.1 pips |

| Available Assets | Forex, Commodities, Indices, Currency Indices, Shares, ETFs, Cryptocurrencies |

| Number of Currency Pairs | 90+ |

| Account Types | Standard, Razor & Pro |

| Mobile Trading | Yes |

| 24/7 or 24/5 Trading | 24/5 (24/7 for Cryptocurrencies) |

| Hedging Allowed | Yes |

| Scalping Allowed | Yes |

| Swap Free Account | Yes, including Islamic Accounts |

| Languages | 25 |

| Affiliate Program | Yes |

| Free Educational Resources | Yes |

| Daily Technical Analysis | Yes |

| Platforms | TradingView, cTrader, WebTrader, Mobile App, MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| Payment Methods | |

| Deposit methods | Credit/Debit Cards, eWallets, Bank Transfer, PayPal, Neteller, Skrill, Union Pay and more |

| Withdrawal Methods | Credit/Debit Cards, eWallets, Bank Transfer, PayPal, Neteller, Skrill, Union Pay and more |

| Withdrawal times | Same business day if before 21:00 GMT |

| Withdrawal limits | You can only withdraw up to 90% of your free margin for International Bank Wire Transfers |

| Currencies | Multiple currencies supported, including EUR, GBP, USD, CHF |

| Live Chat | Phone, Email, 24/7 Multilingual Support, Live Chat, WhatsApp, Chatbot available |

| Contact Info | Support email: [email protected] Telephone (Cyprus): +357 25 030 573 Telephone (United Kingdom): +44 (800) 0465 473 Website: https://pepperstone.com/ |

| Social Media Channels | X (Twitter), Facebook, YouTube, LinkedIn, Telegram, TikTok |

*All trading involves risk. It is possible to lose all your capital.

Is Pepperstone a Trusted Forex Broker?

In this 2025 review, we take an in-depth look at Pepperstone, evaluating its trustworthiness and performance. Our analysis covers important factors such as regulation and compliance, security of funds, customer support, online reputation and trading conditions. We then rated Pepperstone using our proprietary FX Trust Score Index, a scoring algorithm, which helps us fairly and accurately evaluate brokers across five key criteria.

Over the past 14 years, Pepperstone has established itself as one of the most respected and trusted brokers in the industry. It operates internationally, complies with multiple jurisdictions and continues to attract traders from around the world.

Pepperstone scored an overall rating of 83.5% which positions it fourth on our leaderboard. Below, we share our detailed 2025 analysis to help you decide whether Pepperstone is the broker of choice for you.

Introduction to Pepperstone: A Brief Overview

Established in 2010, Pepperstone has positioned itself as a technology-driven broker, offering tight spreads and fast execution. Furthermore, it gives traders access to over 1,200 CFDs across eight asset classes, including forex, indices, commodities, shares, ETFs and cryptocurrencies.

The company has also made a significant investment in advanced technology, creating a seamless trading environment for its clients, ensuring security, reliable trade execution and low cost trading.

With offices in major financial hubs of the world, the broker currently serves a clientbase spanning 160 countries, offers trading in over 25 languages and offers flexible options such as no inactivity fees and swap-free Islamic accounts.

Is Pepperstone Safe?

Licensing and Regulation

Pepperstone is regulated by many top-tier regulatory authorities including ASIC (Australia), FCA (UK), DFSA (UAE), CySEC (Cyprus), CMA (Kenya), SCB (Bahamas), DFSA (United Arab Emirates) and BaFin (Germany).

The fact that Pepperstone adheres to multiple financial bodies assures traders of its commitment to compliance, transparency, fair trading, fund security and operational standards. It is subject to ongoing audits and reporting requirements, plus each regulatory body provides a clear channel to dispute resolution that Pepperstone must adhere to.

Such high standards in compliance gives traders an extra level of confidence.

Regulatory status and licensing details below are verified against primary regulatory registers and official disclosures.

Primary sources (regulatory registers)

- Australian Securities & Investments Commission (ASIC) – Professional Registers

- UK Financial Conduct Authority (FCA) – Financial Services Register

- Dubai Financial Services Authority (DFSA) – Public Register (UAE)

- Capital Markets Authority (CMA) – Kenya (Licensed entities)

- Securities Commission of The Bahamas (SCB) – Registrants & Licensees

- Federal Financial Supervisory Authority (BaFin) – Germany (Institution database)

Security of Funds and Protection

Pepperstone reassures clients that client safety is of top priority and in reality, its operations reflect this. All trader deposits are held in segregated accounts with top-tier banks and are kept entirely separate from the broker’s own funds. This essentially means that client funds are not touched for business expenses or hedging risk.

Additionally, Pepperstone offers Negative Balance Protection, which acts a safeguard against volatile market moves, so traders cannot lose more money than they have deposited. Pepperstone is also a member of the Financial Services Compensation Scheme (FSCS), which means that UK clients in particular, benefit from cover should anything go wrong.

All of this adds an extra layer of reassurance and contributes to its regulation (80%) and security of fund protection (85%) scoring.

Pepperstone Trading Platforms

Pepperstone offers a strong lineup of well-known platforms including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader and TradingView.

-

MetaTrader 4 (MT4) is still the most widely used trading platform and is valued for its stability, ease of use and support for automated strategies via Expert Advisors (EAs).

-

MetaTrader 5 (MT5) is a more advanced version of MT4 and offers additional order types, timeframes and improved testing features.

-

cTrader an intuitive platform designed for professional traders which includes depth-of-market data, advanced charting and strong algorithmic trading capabilities.

-

TradingView is one of the most popular web-based platforms, which allows in-depth charting and the ability for traders to follow and share strategies with other traders.

Clients also have access to Smart Trader Tools and Autochartist, enhancing trade execution and market analysis.

All platforms are available on desktop, web and mobile, allowing Pepperstone clients to trade the markets anytime, anywhere.

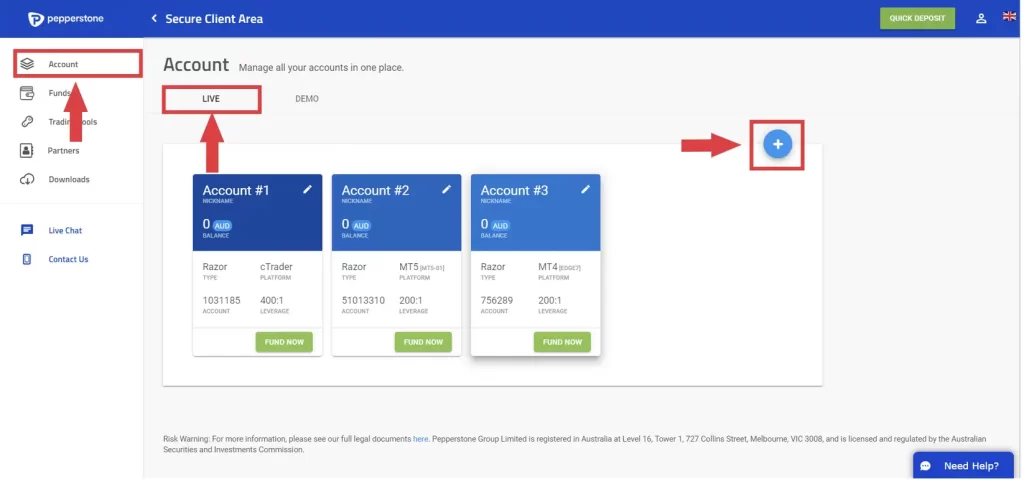

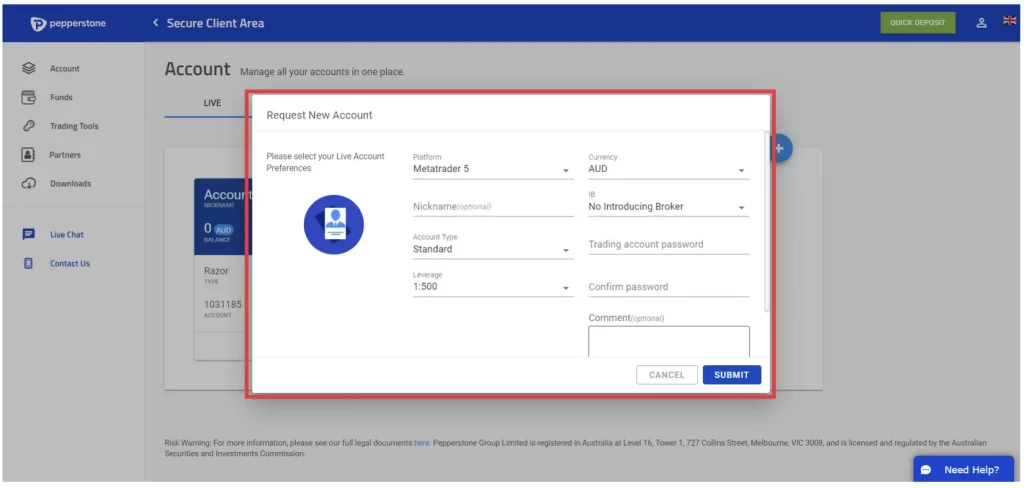

Pepperstone Account Types

Pepperstone broker offers three live accounts including the Standard, Razor and Pro account, each designed for different types of traders. Islamic swap-free accounts are also available to those who qualify.

Standard Account – no commissions, spreads from 1.0 pip. This account is straightforward and well-suited for newer traders.

Razor Account – institutional-style pricing with raw spreads from 0.0 pips, plus a commission of $3.50 per side per lot. Favoured by scalpers and high-frequency traders.

Pro Account – available for eligible professional clients, offering higher leverage (up to 1:500) and more flexible trading conditions.

There is a no minimum deposit requirement across all three accounts and the minimum position size is just 0.01 lot across the board. Traders can also choose to trade in EUR, USD, or GBP base currencies. Let’s look at the account comparison table:

|

Account Type Feature ↓ |

Standard |

Razor |

Pro |

|

Minimum Deposit |

$0 |

$0 |

$0 |

|

EUR/USD Spreads |

From 1.0 pips |

From 0.0 pips |

From 0.0 pips |

|

Leverage |

Up to 1:30 |

Up to 1:30 |

Up to 1:500 |

|

Margin Call |

90% |

90% |

80% |

|

Stop Out |

50% |

50% |

50% |

|

Base Currencies |

USD, EUR, GBP |

USD, EUR, GBP |

USD, EUR, GBP |

|

Minimum Position Size |

0.01 lot |

0.01 lot |

0.01 lot |

Pepperstone’s margin requirements vary between accounts:

Margin call: 90% (80% for Pro accounts)

Stop-out: 50% across all accounts

This structure gives traders flexibility in choosing the balance of cost, leverage and risk management that fits their strategies.

Pepperstone Trading Assets

Pepperstone provides access to more than 1,200 tradable instruments, covering 90+ major, minor and exotic forex pairs, 1,000+ share CFDs from global markets, 20+ popular cryptocurrencies, global indices, commodities, ETFs and currency indices.

Markets move in many directions and with access to 1,200 instruments, traders can take advantage of wide diversification opportunities, all from one account.

Trading Conditions at Pepperstone

Spreads and Commissions

Pepperstone’s pricing is highly competitive, with low spreads. On the Standard account, typical FX spreads start from 1.0 pip (e.g. EUR/USD averages 1.1 pips). The Razor account provides raw spreads from 0.0 pips plus a $3.50 commission per side per standard FX lot (pro-rated for trades under 1 lot).

As examples, EUR/GBP typically starts from 1.2 pips on Standard and 0.2 pips on Razor.

This cost structure is suited to scalpers, day traders and automated systems, where tighter spreads and predictable commissions can actually improve trading efficiency.

Leverage

The leverage available through Pepperstone varies depending on both the client’s location and the instrument being traded. In regions governed by CySEC, retail clients are limited to a maximum of 1:30 and eligible professional clients can qualify for up to 1:500 on forex and a broader range of assets.

For retail traders, leverage is set according to asset class:

1:30 – major currency pairs

1:20 – non-major currency pairs, gold and major indices

1:10 – commodities other than gold and on non-major equity indices

1:5 – individual equities

1:2 – cryptocurrencies

Pepperstone has set a tiered structure which gives greater flexibility, however traders are advised to confirm what and how leverage will be applied to their trades, before they begin. It is very easy to get in touch with the client support team at Pepperstone for some quick answers (see Client Support tab of our ‘Pepperstone at a Glance’ table above).

Pepperstone Customer Support

Pepperstone ranks highly (90%) for its customer support services. Unlike many brokers that only provide assistance during weekdays, Pepperstone offers multilingual phone support 24/7. Traders can also contact the support team via email or live chat.

From our experience, live chat response times were well under 1 minute and support representatives gave us full confidence that they were able to handle a wide range of issues. We received all the details we needed up front, that would help us get started with registering account and making a first deposit. They were able to confirm available deposit and withdrawal methods, withdrawal times and details such as minimum deposit required for all accounts.

This 24/7 availability and responsiveness makes Pepperstone one of the stronger choices for traders who value strong support. With more brokers introducing live chatbots, clients are becoming increasingly stressed and anxious – when issues arise, it is much more preferable to talk to a human, especially regarding sensitive or confidential issues.

Educational Resources for Pepperstone Traders

Pepperstone places a strong emphasis on trader education, having created a wealth of educational resources for beginner and advanced traders. The broker provides online courses, strategy workshops and regular webinars covering current market themes. Clients can also gain access to a specialised MT4 course and a detailed trading glossary that explains technical trading terms and concepts.

The broker also has a YouTube channel and runs a Podcast series. The YouTube channel offers a large selection of tutorials on forex basics, trading platforms and charting techniques. The Podcast series adds another dimension, featuring discussions with analysts and industry experts.

Daily market analysis and commentary is provided across social media channels to keep traders aware of market developments and what analysts anticipate will happen.

Pepperstone’s educational resources support traders and provide continuous learning opportunities. The more educated a trader, the more successful he/she will be, so a broker’s investment in education is crucial and scores points.

Pepperstone’s Reputation: What Traders are Saying

Across well-known forums and reputable review sites, Pepperstone appears to have a positive reputation overall. Reviewers frequently mention the broker’s low spreads and fast execution speeds. It also receives strong feedback on its trading platforms, advanced tools and educational resources.

Customer support 24/7 is another area that traders speak highly of and we did not see evidence of communication being cut or clients not receiving answers to their questions. In many cases, Pepperstone representatives take to review sites and direct clients back to the website to seek proper assistance.

Pepperstone’s positive online reputation together with its adherence to strict a regulatory framework proves that it is a trustworthy and reliable broker with whom clients can trade with confidence.

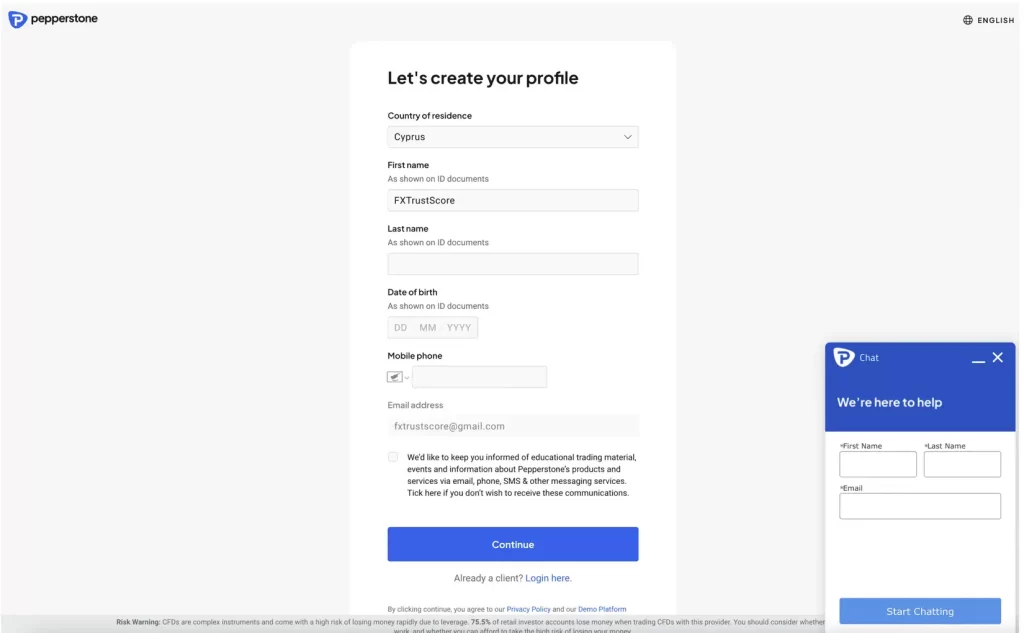

How to Open an Account

Opening an account with Pepperstone is straightforward – just follow these steps:

- Visit the Pepperstone website and select Join Now.

- Select to sign up using Apple, Google, Facebook or Email.

- Create your Profile by filling in your personal details and click Continue.

- If you need assistance, use the Live Chat feature (bottom right).

- Your account will be created and you can access the secure client area where you can create your Demo and Live Trading Accounts.

- Upload the required KYC documents to verify your account.

- Once verified, you can choose your preferred account type and base currency.

- Open a demo account and test!

Featured Promotions

Pepperstone offers two ‘Refer a Friend’ programs, one for retail clients and another for Pepperstone Pro clients. High volume traders can also take advantage of the exclusive ‘Active Trader’ program.

- Refer a Friend Program: Retail clients and their friends can earn up to 20 commission-free trades 20 trades on eligible FX and share CFDs when their referral deposits $2,000 within 90 days of opening an account. Professional traders and their friends can each receive a bonus of between $50 and $1,000 depending on how many lots are traded by their referral within 90 days of opening an account.

- Active Trader Program: Aimed at high-volume traders, this promotion allows participants to earn rebates based on their monthly trading volume. Clients can get rebates on forex (15% to 25%), indices (10% to 20%) and commodities (5% to 15%), according to the specific volume traded. The rebates are paid daily or monthly, depending on the account type used.

The FXTS Verdict: Is Pepperstone a Trusted Broker?

Our independent analysis found that Pepperstone is a strong performer in the forex industry and a safe option for traders. Its reputation is supported by consistently low spreads, fast execution speeds and a solid range of platforms that suit both beginners and advanced traders. Its educational resources, technical analysis and webinars provide the support traders continuously need on their journey.

The availability of 24/7 customer support also sets Pepperstone apart from many competitors, particularly for traders who need help over the weekend. Plus, clients can talk with a human rather than a chatbot.

Pepperstone may not be cheapest choice for every product and some traders may prefer brokers that offer a wider selection of account types or asset classes, but nevertheless, its offering is good.

To conclude, the FX Trust Score verdict is that Pepperstone offers a safe, reliable, well-regulated environment with trading conditions that are highly competitive for active clients.

Latest Pepperstone Review facts, licensing, scores and data re-verified in early 2026 and manual checks made by FX Trust Score.

*All trading involves risk. It is possible to lose all your capital.

Compare this broker

See how Pepperstone Review stacks up against other brokers we have reviewed:

FAQs

Yes, Pepperstone is considered a trusted broker. It is regulated by several top-tier financial authorities including the Australian Securities and Investments Commission (ASIC), the UK’s Financial Conduct Authority (FCA), and the Cyprus Securities and Exchange Commission (CySEC). These regulatory bodies ensure that Pepperstone adheres to strict financial standards and operational guidelines, providing a secure and transparent trading environment for its clients.

Pepperstone ensures client funds are always kept secure thanks to implementing a range of protective measures. The broker holds client money in segregated accounts at top regulated banks and does not use client funds for its own hedging purposes, while it is also a member of the UK’s Financial Services Compensation Scheme (FSCS).

Pepperstone was originally founded in Melbourne, Australia in 2010. In the years since its establishment, the broker has expanded significantly, serving clients in multiple countries across the globe, while maintaining its headquarters in Australia.

Yes, Pepperstone is regulated in Europe. It is fully licensed and authorised by the Cyprus Securities and Exchange Commission (CySEC) and the UK’s Financial Conduct Authority (FCA), ensuring compliance with strict financial standards and providing secure trading conditions in the European market.

Pepperstone does not require a minimum deposit to open a trading account, making it very accessible for traders who may want to start with a smaller amount of capital. This flexibility allows both novice and experienced traders to begin trading with an amount they feel comfortable with.