Spreads often widen during volatile market conditions, changing execution quality and trading costs. This guide explains why it happens, when to expect it and what traders should pay attention to.

Spreads are often treated as background noise. Most of the time, they are small, predictable and easy to ignore. However, during periods of market volatility, spreads stop being passive and start becoming a real cost – in many cases, the most important one.

Unexpected spread widening is one of the first signs that market conditions have changed. Understanding why it happens, when it happens and how brokers handle it, can make a meaningful difference to both performance and risk management.

What a spread really represents

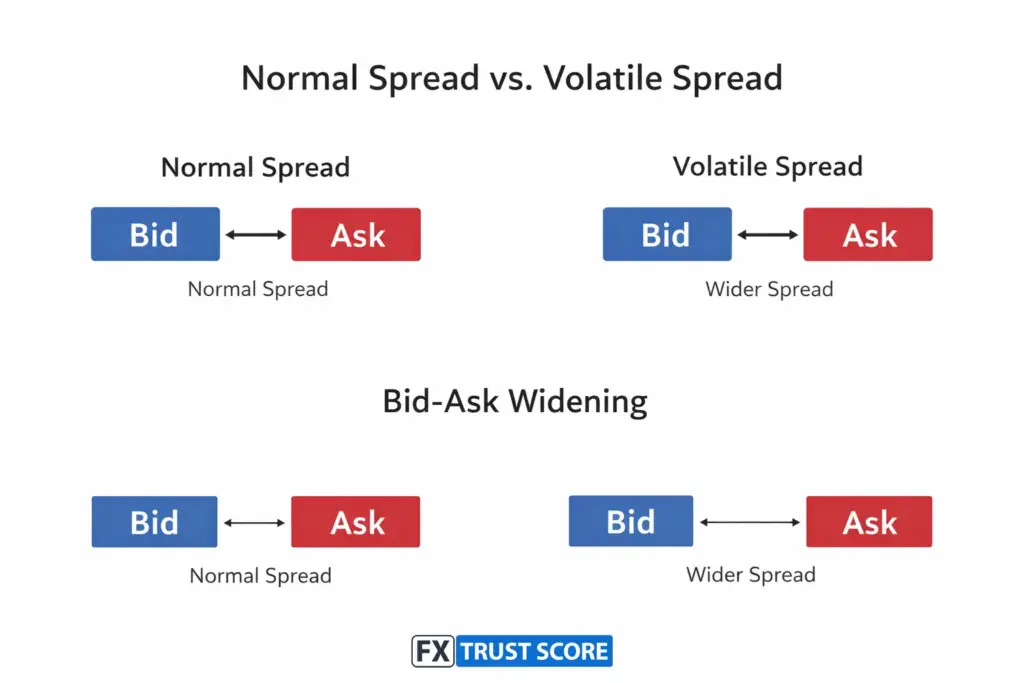

To put it simply, the spread is the difference between the bid and ask price. In practice, it reflects something more complex; liquidity, risk and the ability of the broker to source prices from the market.

In calm conditions, liquidity is deep and competition between price providers keeps spreads tight. During volatile periods, this balance shifts and prices move faster, liquidity thins and the cost of executing trades increases. Spreads do not widen randomly. They respond to stress.

Periods of heightened volatility, like the ones traders are navigating now, often expose how quickly spreads and execution conditions can change.

Why volatility causes spreads to widen

Volatility creates uncertainty and uncertainty increases risk for everyone involved in the trade. For example, around major central bank announcements, spreads on highly liquid pairs such as EUR/USD often widen briefly as prices adjust and liquidity providers manage increased uncertainty. When prices move quickly, liquidity providers face a higher chance of being filled at unfavourable prices. To compensate, they widen spreads. Brokers, depending on their model, may pass this on directly or add an additional buffer to manage their own exposure.

Spread behaviour often changes during:

- Major economic data releases

- Central bank announcements

- Geopolitical events

- Thin trading hours, such as session overlaps or market opens

During these moments or events, the market adjusts.

For traders still building their foundations, understanding how spreads work is a key part of learning how the forex market really functions.

Fixed vs variable spreads under pressure

The way spreads behave during volatility depends heavily on a broker’s pricing model.

With variable spreads, widening is expected. Prices reflect live market conditions, so spreads expand when liquidity drops and contract when it returns. This may feel uncomfortable, however it is often more transparent.

With fixed spreads, the picture is less straightforward. Fixed does not always mean unchanging. Many brokers reserve the right to adjust spreads or impose trading restrictions during extreme conditions. When volatility spikes, execution quality may deteriorate, even if the headline spread looks stable.

Understanding this distinction is more important than simply choosing the lowest advertised spread.

When traders feel spread widening the most

Spread changes are most noticeable at specific times:

- Just before or after high-impact news

- During sudden price gaps

- In fast-moving breakout conditions

- On less liquid currency pairs

A similar effect can be seen around high-impact economic data releases, where spreads may widen just before and immediately after the data is published, even on major currency pairs. For short-term traders, even small changes can significantly affect entries, exits and stop-loss placement. For longer-term traders, spread widening may matter less, unless it coincides with execution delays or slippage. The impact is essentially about control.

How spreads affect risk management

During volatile conditions, wider spreads effectively reduce usable price space. Stop-losses may trigger earlier than expected and trades that look viable on a chart can become marginal in practice. Experienced traders often adjust their behaviour during volatility:

- Reducing position size

- Allowing wider stops

- Avoiding trading around key releases

- Focusing on pairs with deeper liquidity

Spreads change the price but also change the risk profile of a trade.

During volatile conditions, brokers with consistently fast execution tend to handle spread changes more predictably, reducing the risk of slippage and delayed fills.

What spreads reveal about a broker

How a broker handles spreads during volatility tells you a lot about their infrastructure. Consistent, explainable spread behaviour usually points to strong liquidity relationships and transparent execution. Sudden, unexplained spike, especially outside known events, may signal weaker pricing or internal risk controls.

This is one reason why execution reliability matters as much as headline costs. Tight spreads in calm markets mean little if they become unpredictable when conditions change.

Conclusion

Volatility exposes how the market really works. Spreads widening during volatile periods is a reflection of risk being repriced in real time. Traders who understand this are better equipped to adapt, protect capital and choose trading conditions that suit their strategy. Ignoring spreads is easy when markets are calm, however, understanding them becomes essential when they are not.

Helpful FAQs

Spreads widen because liquidity providers face greater risk when prices move quickly. To manage that risk, they increase the difference between bid and ask prices, which is then reflected in trading costs.

Most brokers experience some degree of spread widening during volatile conditions. The difference lies in how consistently and transparently this happens, which often depends on liquidity access and execution infrastructure.

Not necessarily. Wider spreads are usually a normal response to changing market conditions. They reflect risk being repriced rather than a breakdown in the market itself.

Many traders adjust position size, avoid trading during major announcements, or focus on more liquid instruments when volatility increases. Understanding spread behaviour is an important part of managing risk.