Our AvaTrade review 2026 provides valuable insights you may wish to consider before trading with this leading forex broker. Enhancing your knowledge and understanding can help you make better-informed trading decisions and invest with greater confidence.

FX Trust Score Index – AvaTrade

AvaTrade gained an overall score of 85.75% across our five key ratings criteria.

Compare this broker against others in our Broker Data Index.

FX Trust Score Index Ratings

How we calculate the FX Trust Score How we calculate the FX Trust Score:

• Regulation & Compliance (30%)

• Security & Fund Protection (20%)

• Customer Support (15%)

• Online Reputation (20%)

• Trading Conditions (15%)

Evaluation scope

Evaluation Scope

FX Trust Score assessments are based on verifiable regulatory, security,

operational and market conduct criteria. User-submitted reviews and

testimonials are not used as scoring inputs due to susceptibility to manipulation.

Score revision policy

Score Revision Policy

FX Trust Scores are only updated following material, verifiable changes.

Scores cannot be altered, suppressed or improved through commercial

relationships or paid services.

🔍 Looking for quick facts?

View the AvaTrade profile

for company background, regulation, trading conditions and contact links.

AvaTrade Broker Pros and Cons

- Licensed & Regulated

- Strong educational resources

- Hedging and scalping allowed

- Proprietary copy trading tools

- Multiple trading platforms

- High inactivity fees

*All trading involves risk. It is possible to lose all your capital.

AvaTrade at a Glance

-

AvaTrade Overview

-

Client Support

| Overview | |

| Year Established | 2006 |

| Licences Held | ASIC (Australia), MiFID (EU), FSCA (South Africa), JFSA (Japan), ADGM (UAE), ISA (Israel), FSC (British Virgin Islands), PFSA (Polish Financial Advisory Authority), FSRA (Middle East) |

| Demo Account Available | Yes |

| Base Currencies | EUR, USD, GBP, CHF, JPY, AUD, ZAR |

| Promotions | Yes |

| Account Opening Time | Within 24 hours |

| Withdrawal Fee | None |

| Inactivity Fee | $50 after three months of inactivity |

| Minimum Deposit | $100 |

| Minimum Position Size | 0.01 lot |

| Maximum Leverage | Up to 1:400 |

| Spread Type (Fixed/Variable) | Fixed & Variable (Retail from 0.9 pips, Standard from 0.9 pips, Pro from 0.6 pips) |

| Average Spread (based on EUR/USD) | 0.9 pips |

| Available Assets | Forex, Commodities, Indices, Stocks, ETFs, Bonds, Cryptocurrencies |

| Number of Currency Pairs | 60+ |

| Account Types | Standard |

| Mobile Trading | Yes |

| 24/7 or 24/5 Trading | 24/5 (24/7 for Crypto) |

| Hedging Allowed | Yes |

| Scalping Allowed | Yes |

| Swap Free Account | Yes, including Islamic |

| Languages | 25 |

| Affiliate Program | Yes |

| Free Educational Resources | Yes |

| Daily Technical Analysis | Yes |

| Platforms | AvaOptions, AvaTradeGO, AvaSocial, WebTrader, MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| Payment Methods | |

| Deposit methods | Credit/Debit Cards, eWallets, Bank Transfer, Skrill, WebMoney, Neteller and others. |

| Withdrawal Methods | Credit/Debit Cards, eWallets, Bank Transfer, Skrill, WebMoney, Neteller and others |

| Withdrawal times | Within 48 hours |

| Withdrawal limits | None |

| Currencies | Multiple currencies supported, including EUR, GBP, USD, CHF |

| Live Chat | Live Chat, WhatsApp, Phone, Email, 24/5 Multilingual Support, Chatbot available |

| Contact Info | Support email: Form on Contact Us page Telephone (Cyprus): +357 25 030235 Telephone (United Kingdom): +44 203 307 43 36 Website: www.avatrade.com |

| Social Media Channels | X (Twitter), Facebook, YouTube, Instagram, LinkedIn, TikTok |

*All trading involves risk. It is possible to lose all your capital.

Is AvaTrade a Trusted Forex Broker?

AvaTrade was founded in 2006 and operating for nearly two decades, it isi one of the longest-established brokers in the forex industry. In this review, we took a closer look at AvaTrade and evaluated the broker across five key criteria: regulation, security of funds, customer support, online reputation and trading conditions. We also delve further into its product offering and what traders can expect.

AvaTrade scored highly with an overall total of 85.75%, placing it in third position when put up against other brokers we have reviewed. It scored well across our FX Trust Score Index, particularly excelling in regulation and compliance and security of funds.

This review presents our findings and we trust that it will provide important insights that could help traders judge whether AvaTrade is a viable choice of broker. Read on!

Introduction to AvaTrade: A Brief Overview

AvaTrade was established in 2006 and is headquarted in Dublin, Ireland. In recent years, it has achieved significant international growth and now serves a large client base spanning 150 countries. It offers more than 1,000 financial instruments and supports trading on both MT4 and MT5 as well as its proprietary systems, AvaTradeGO, AvaOptions and AvaSocial).

AvaTrade currently holds nine regulatory licences, across different jurisdictions which shows its commitment to compliance and that fund security and fair trading is of top priority.

Is AvaTrade Safe?

Licensing and Regulation

AvaTrade is fully licensed and regulated in nine jurisdictions, including leading tier-one financial authorities such as the Central Bank of Ireland (MiFID), Australian Security & Investments Commission (ASIC) in Australia, the FSCA in South Africa, JFSA in Japan and the Canadian Investment Regulatory Organization (CIRO). It also holds approvals in Israel (ISA), Abu Dhabi (ADGM), the British Virgin Islands (FSC), Poland (PFSA) and the Middle East (FSRA).

AvaTrade maintains very broad coverage which added a significant weight to its trust profile. Licence validity was checked with the relevant registries in February 2026.

Regulatory status and licensing details below are verified against primary regulatory registers and official disclosures.Primary sources (regulatory registers)

- Central Bank of Ireland (CBI) – Register of authorised firms (MiFID)

- Australian Securities & Investments Commission (ASIC) – Professional Registers search

- Financial Sector Conduct Authority (FSCA) – South Africa (FSP register search)

- Japan Financial Services Agency (JFSA) – List of licensed (registered) financial institutions

- Canadian Investment Regulatory Organization (CIRO) – Dealer directory (“Dealers we regulate”)

- Israel Securities Authority (ISA) – Official regulator site

- Abu Dhabi Global Market (ADGM) – FSRA Public Register

- British Virgin Islands Financial Services Commission (BVI FSC) – Public Search

- Polish Financial Supervision Authority (PFSA / KNF) – Entities search

- Middle East (FSRA) – FSRA Public Register (ADGM)

Security of Funds and Protection

AvaTrade client deposits are safeguarded through segregated accounts, ensuring that funds remain separate from company funds. This is clearly stated in the Client Assets Key Info document on the website.

In terms of web security, it implements robust measures including:

- 256-bit SSL encryption across the entire website

- Embedded True-Site identity assurance seal

- Ava is WebTrust compliant, as determined by the American Institute of Certified Public Accountants

- Ava uses McAfee Secure (HackerSafe) to prevent credit card fraud and identity theft

- All client money is segregated from AvaTrade business funds.

A distinctive security feature is “AvaProtect”, which enables traders to insure trades for a fixed period, at a set cost. Losses on these insured trades can then be fully reimbursed up to $1 million, minus the protection fee. Whilst this does not necessarily eliminate trading risk, it is a safeguard and adds value to AvaTrade’s trust profile.

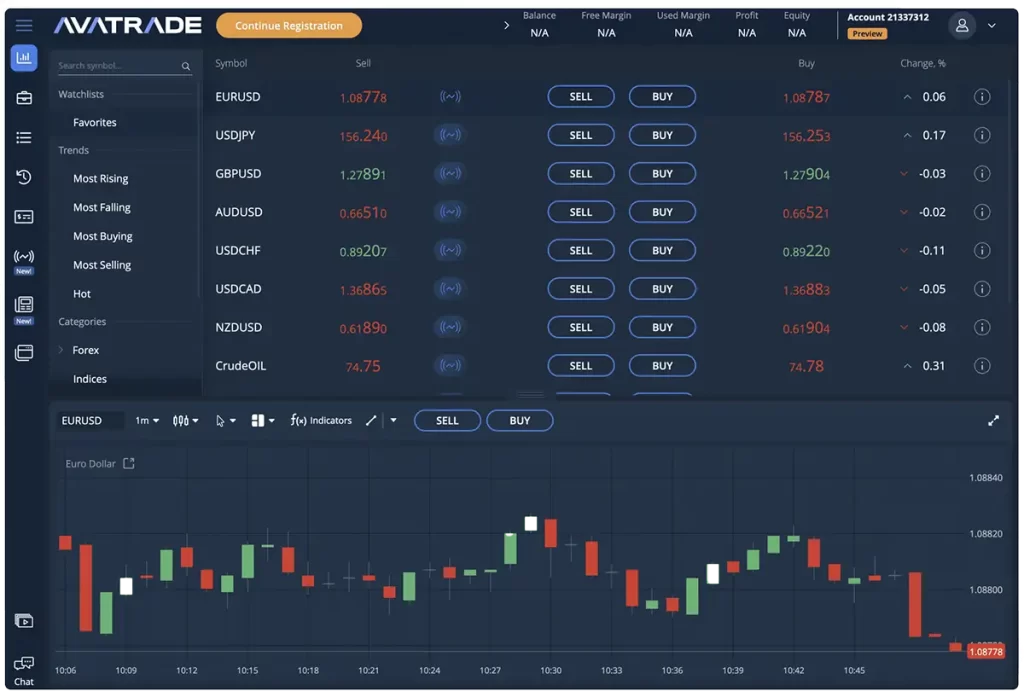

AvaTrade Trading Platforms

AvaTrade provides access to a wide range of platforms to suit different preferences:

MT4 and MT5: industry-standard platforms for charting, analysis and automated trading.

AvaTradeGO: the broker’s proprietary and award-winning mobile app, which boasts social features and integrated risk management tools.

AvaSocial: a copy trading platform that allows beginner traders to follow and copy the trades of experienced traders.

WebTrader: a browser-based platform for quick access without downloads.

AvaOptions: a platform which allows forex options trading and features advanced analytical and risk management tools.

Our testing found the proprietary apps to be user-friendly and well-integrated which is positive for traders and the entire platform suite is substantial enough to cater to the needs of all traders.

AvaTrade Account Types

AvaTrade operates a simple account model. Traders can open a Standard live account, which offers both fixed and variable spreads. Once KYC verification is passed, traders can proceed to fund their accounts with USD, EUR or GBP. A Swap-free Islamic account is also available to qualifying traders and demo accounts can e opened for practice.

The minimum deposit requirement for the Standard account is $100, which makes trading very accessible. Retail account spreads begin from 0.9 pips and Pro conditions start at 0.6 pips. While the simplicity of having a single account is appealing, traders used to tiered account structures with bespoke conditions will find fewer options here, compared to other large brokers.

|

Account Type → Feature ↓ |

Standard |

|

Minimum Deposit |

$100 |

|

EUR/USD Spreads |

From 0.8 pips |

|

Leverage |

Up to 1:400 |

|

Margin Call |

50% |

|

Stop Out |

10% |

|

Base Currencies |

USD, EUR, GBP |

|

Minimum Position Size |

0.01 lot |

AvaTrade Trading Assets

AvaTrade offers more than 1,000 tradable instruments across multiple asset classes. These include 55 forex pairs, 27 commodities, 31 indices, 58 ETFs, government bonds, 600+ equities, options and over 16 major cryptocurrency pairs.

Aside from taking advantage of AvaTrade’s broad product range, clients can also trade crypto around the clock, which adds further flexibility and opportunity for those looking at trading on digital assets.

Trading Conditions at AvaTrade

Spreads and Commissions

AvaTrade follows a spread-only model for most instruments, with no added commission fees incurred by traders. Spreads on EUR/USD are approx. 0.9 pips for Retail account holders and 0.6 pips for Pro account holders.

Pricing appears to be competitive within the markets, however spreads quoted by AvaTrade vary across different asset classes and should be reviewed before trading. If there is any uncertainty, it is always advisable to ask a client support representative on live chat or email.

Leverage

The maximum leverage is up to 1:400 but depends on the regulatory jurisdiction of the client’s country of residence. In the EU and the UK, leverage is capped to 1:30 for major currency pairs, by European Securities and Markets Authority (ESMA) regulations. Leverage is capped even lower for crypto and exotic currency pairs. International accounts may be able to access higher leverage ratios.

Essentially, this approach ensures compliance but the fact that conditions differ across regions means that traders should clarify which leverage is available or applicable, ahead of opening any trades.

AvaTrade Customer Support

AvaTrade offers multilingual customer support 24/5, via telephone, email, WhatsApp and live chat. A chatbot is also on hand to answer simple faq-style questions 24/7.

Native language support is available in English, Spanish, French, German, Italian, Portuguese, Arabic and Russian, whilst it also lists local phone numbers for 36 countries spanning Europe, Africa, Asia, North America, the Middle East, Oceania and South America.

During our testing, AvaTrade live chat had fast response times with support representatives answering in less than 30 seconds. This was the case on multiple occassions, across different days of the same week. Interaction was pleasant and we received answers to all of our questions, allbeit they were more product related rather than serious issues. Overall, we were happy with the support team’s reliability and willingness to assist.

One downside is the fact that customer support is only available 24/5, so traders seeking answers or help over the weekend will be met with the live chatbot or they can consult the company’s FAQs. The FAQs address common queries related to deposits, withdrawals and platform usage.

Educational Resources for AvaTrade Traders

AvaTrade has developed a well-structured and extensive Education Center aimed at both beginner and intermediate traders. Content includes eBooks, videos, step-by-step guides and webinars. The ‘Ava Academy’ also offers a wide range of trading courses covering topics related to forex, commodities, stocks, indices, bonds, ETFs and cryptocurrencies. Each course consists of 21 in-depth lessons and constitutes a mixture of articles, videos and quizzes.

The broker also shares daily analysis and commentary which can help traders link theory with practice.

Our review found that AvaTrade offers extensive courses which are extremely useful for foundational learning, but we were not sure whether advanced traders would find the same value as those on beginner and intermediate levels. However, it is a very strong educational resource section and is updated regularly.

AvaTrade’s Online Reputation: What Traders are Saying

A look at a variety of independent reviews across different review platforms paint the picture that AvaTrade has a positive reputation within the trading community. Many clients made reference to the fact that the Ava Academy had been of great value and help in getting started and continues to be a valuable resource.

The AvaSocial platform also receives good comments as it is easy-to-use and allows traders to connect with mentors, ask questions and copy trades directly.

Much of AvaTrade’s credibility in the market is based on the fact that it holds so many licenses and complies with multiple jurisdictions. This has helped them build a strong reputation and ultimately, reinforces trader confidence.

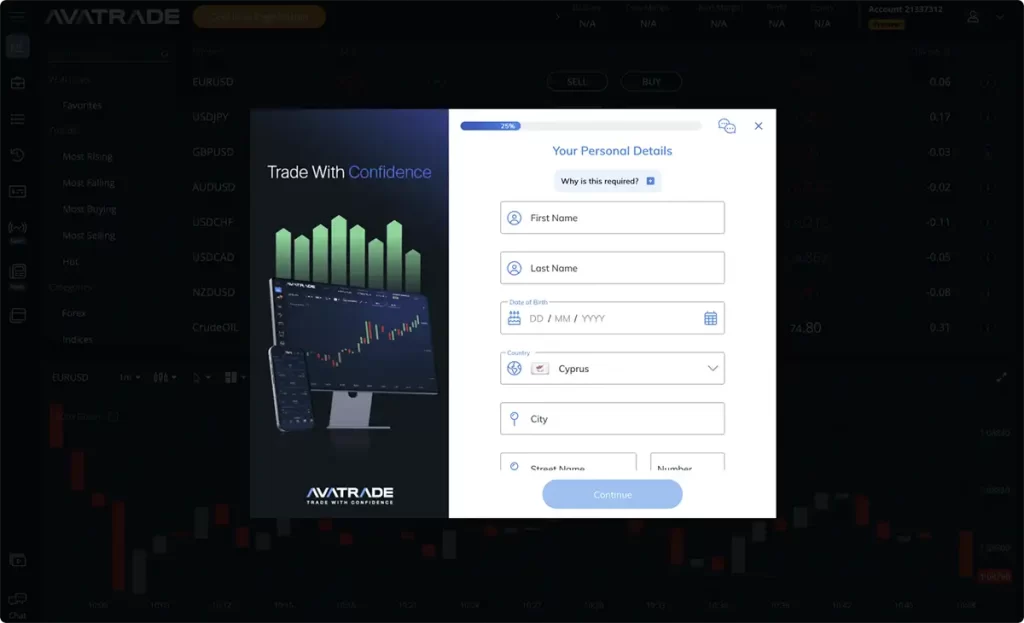

How to Open an Account

Open an account with AvaTrade by following these simple steps:

- Visit the AvaTrade homepage and click Register Now.

- Enter your chosen email address and password, then click Create My Account.

- A registration form will appear prompting you to complete your personal details.

- Once submitted, you will be directed to the Trading Platform.

- If you pause the process, you can resume later by selecting the orange Continue Registration button.

- To fully activate your account, you must upload the required KYC (Know Your Customer) documents, which are mandatory before dpeosits, withdrawals or live trading can take place.

Featured Promotions

AvaTrade offers welcome bonuses and other promotional offers for clients, depending on region and regulations. Current promos include:

- Refer a Friend: Clients can earn up to $250 as a referral bonus for every friend that deposits and trades. To qualify for this promotion, they need to share a unique referral link with their friends through Facebook, WhatsApp or Gmail. Once their friends open a real trading account, make a minimum first-time deposit (FTD) of $500 and open at least 10 trades, the client will receive cash credit ranging from $50 to $250, depending on their friend’s FTD amount.

- Regular Bonuses: AvaTrade occasionally updates its promotional campaigns, which vary according to geographical region. In the past, the broker has offered several attractive promotions to its clients, ranging from generous welcome and deposit bonuses. To find out the latest offers available at AvaTrade, clients are encouraged to visit the broker’s official website to see how they can receive a trading boost.

The FXTS Verdict: Is AvaTrade a Trusted Broker?

Following our detailed review, AvaTrade has demonstrated the qualities of an established, well-regulated broker that offers a competitive product range. The broker particularly performs well in areas such as regulation and compliance, education and trading platform offering.

The Ava Academy and AvaSocial features provide useful tools for both beginner and advanced traders.

Its promotional offers may be less competitive compared to the offers of other brokers, however, it compensates with competitive spreads, attractive trading conditions and a large number of tradable instruments.

Overall, our independent assessment concludes that AvaTrade is a reliable option for traders of all experience levels, it has a proven and strong track record and it puts security of funds and fair trading at the top of its priorities which is clear from the multiple jurisdictions in which it is licensed. A good, solid choice for traders.

Latest AvaTrade Review facts, licensing, scores and data re-verified in early 2026 by FX Trust Score experts.

*All trading involves risk. It is possible to lose all your capital.

Compare this broker

See how AvaTrade Review stacks up against other brokers we have reviewed:

FAQs

AvaTrade is recognised within the online trading community as being a trusted broker, thanks largely to its steadfast commitment to regulatory oversight in no less than nine jurisdictions. Since being founded in 2006, the company has built up a solid reputation over the years for providing reliable trading services and prompt customer support.

AvaTrade prioritises the safety of client funds and is considered a secure place for your money, underscored by various robust safety measures. The broker is fully authorised by multiple tier-1 regulators across the world, meaning it maintains strict adherence to stringent operational standards. Furthermore, AvaTrade ensures the segregation of client finds, employs advanced security technologies and offers risk management tools like negative balance protection, helping clients control losses and trade within safe limits.

AvaTrade has a minimum deposit of just $100 across its Retail, Standard and Professional account types.

AvaTrade has a seamless withdrawal process, enabling clients to receive their money promptly and stress-free. The broker states that it will only take between 24-48 hours to complete the withdrawal process once a client’s account has been verified, compared to other brokers who have a timeline of up to 8 days to process a withdrawal request.

AvaTrade is an established global broker, pioneering online trading in a competitive marketplace since the company was first founded back in 2006. It is one of the world’s most secure brokers, with seven regulations across six continents, while at the same time offering a wide choice of assets, leading platforms and attractive trading conditions.